Table of contents

- Main points

- Statistician’s comment

- Summary

- UK economy grew by 0.4% in Quarter 3 (July to Sept) 2017

- Services and manufacturing output expand in Quarter 3 (July to Sept) 2017

- Construction continues to weigh on growth in Quarter 3 (July to Sept) 2017

- Despite falls in recent months, economic confidence in the UK rises for the fourth consecutive quarter

- London has seen weaker average house price growth than the UK as a whole since December 2016

- UK unemployment rate remains at its lowest since 1975

1. Main points

The preliminary estimate of gross domestic product (GDP) shows that the UK economy grew by 0.4% in Quarter 3 (July to Sept) 2017, following growth of 0.3% in the previous quarter.

Growth in Quarter 3 2017 was driven by an expansion in production and services output, while construction continued to act as a drag.

London has seen weaker average house price growth than the UK as a whole since December 2016, partly due to a fall in the average level of transactions.

In the three months to August 2017, the unemployment rate remains at its lowest since 1975 and in real terms, average weekly earnings fell by 0.4% on the previous year (excluding bonuses).

Longitudinal analysis of flows across the labour market shows that the gross outflow from employment is at its lowest since the three months to March 2006, supporting headline rates of high levels of employment.

2. Statistician’s comment

Commenting on today’s gross domestic product (GDP) figures, Head of National Accounts Darren Morgan said:

“Growth in the third quarter of 2017 continued at a similar rate as seen in the first half of the year. Services, led by increases in IT, motor trades and retail, continued to drive GDP growth. Manufacturing also boosted the economy with an improved performance after a weak second quarter.

“However, construction output fell for the second consecutive quarter, although it remains above its pre-downturn peak.”

Back to table of contents3. Summary

The UK economy grew at 0.4% in Quarter 3 (July to Sept) 2017, slightly up on, but comparable with the 0.3% growth seen in Quarter 1 (Jan to Mar) 2017 and Quarter 2 (Apr to June) 2017. Growth remained at 1.5% on a quarter on previous year’s quarter basis. In contrast to Quarter 2 2017, production contributed positively to growth in Quarter 3 2017, particularly due to strength in the car manufacturing output in July. Services sector output continues to drive growth, and economic confidence in the UK rose for the fourth consecutive quarter in Quarter 3 2017, according to the European Commission’s monthly Economic Sentiment Indicator (ESI).

Growth in London average house prices remains relatively subdued compared with the whole of the UK and previous trends, which may be partly due to a slow-down in housing transactions in London since the end of 2016. The unemployment rate remains at its lowest since 1975 and in real terms, average weekly earnings fell by 0.4% on the previous year (excluding bonuses).

More detailed theme day economic commentary is available for:

Back to table of contents4. UK economy grew by 0.4% in Quarter 3 (July to Sept) 2017

Today’s gross domestic product (GDP) release contains new information regarding UK economic growth in Quarter 3 (July to Sept) 2017. Within this release is an early indication of output growth in production, construction and services in September 2017. In addition, data on services output in August 2017 have been published.

The preliminary estimate of GDP shows that the UK economy grew by 0.4% in Quarter 3 2017, comparable with the 0.3% in each of the first two quarters of 2017 (Figure 1). Over the longer-term, GDP has grown 16.9% since the trough of the economic downturn in 2009 and is currently 9.7% higher than the pre-downturn peak level of output recorded in Quarter 1 (Jan to Mar) 2008.

Figure 1: Gross domestic product growth, quarter-on-quarter and quarter on same quarter a year ago growth rate

UK, Quarter 1 (Jan to Mar) 2008 to Quarter 3 (July to Sept) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 1: Gross domestic product growth, quarter-on-quarter and quarter on same quarter a year ago growth rate

Image .csv .xls5. Services and manufacturing output expand in Quarter 3 (July to Sept) 2017

Growth in services output remained steady at 0.4% in Quarter 3 (July to Sept) 2017 – the same rate of growth as in Quarter 2 (Apr to June) 2017 – contributing 0.3 percentage points to quarterly gross domestic product (GDP) growth. The largest contributor towards services growth was the business services and finance sector, which grew by 0.6%. The distribution, hotels and restaurant sector also contributed positively to quarterly growth, while contributions for the transport, storage and communication, and government and other services sectors were both zero. However, as previous analysis has highlighted, activity in the sector has slowed since 2016 and growth in Quarter 3 2017 continued to be below its five-year average of 0.6%. Quarter-on-year growth also fell to its lowest rate since Quarter 3 2013 (1.5%).

New data on services output in August 2017 have also been published today (25 October 2017). These latest figures show that services output rose by 0.4% in the three months to August 2017. Output rose by 0.2% in August, following a fall of 0.1% in July and a rise of 0.3% in June. Business services and finance was the driver of monthly growth in August 2017 with a rise of 0.3% – contributing 0.1 percentage points towards total services growth (Figure 2). The other three main sectors remained broadly flat in August 2017, with transport, storage and communication down slightly by 0.1% and both distribution, hotels and restaurants, and government and other services up by 0.1% – each of the three sectors made zero contribution towards total services growth in August 2017.

Figure 2: Index of Services by selected components and total services

UK, January 2013 to August 2017

Source: Office for National Statistics

Download this chart Figure 2: Index of Services by selected components and total services

Image .csv .xlsProduction also contributed positively to growth in Quarter 3 2017, which increased by 1.0%. This was buoyed by a pickup in manufacturing, which is showing signs of a revival following a weak start to the year. Manufacturing output grew by 1.0% in the quarter to more than recover the previous quarter’s fall of 0.3%, contributing 0.8 percentage points to total production growth in Quarter 3 2017. This pickup largely reflected a 3.8% increase in the production of motor vehicles, which saw a particularly strong outcome in July 2017 as new car models were rolled off the production line. Strength was also seen in other manufacturing and repair and installation of machinery and equipment, which grew by 5.3% and 3.8% respectively in Quarter 3 2017.

Mining and quarrying also contributed positively to production growth. The monthly path of mining and quarrying in Quarter 3 2017 was marked by fluctuations as output varied according to routine summer maintenance of the North Sea oil rigs, which occurred later than expected in August 2017.

Back to table of contents6. Construction continues to weigh on growth in Quarter 3 (July to Sept) 2017

In contrast, the preliminary estimate of construction shows that total output volumes fell by 0.7% in Quarter 3 (July to Sept) 2017 – the largest quarterly fall since Quarter 3 2012. The preliminary estimate is based on forecasts and early responses to the September Monthly Business Survey and a breakdown of the components of construction is not available until 10 November 2017.

The latest monthly path for construction output in Quarter 3 2017 showed a decline of 1.0% in July 2017 and a rise of 0.6% in August 2017. Despite the pickup in August 2017, the underlying trend for construction has been weakening in recent months. While output remains at high levels, it continued to decline in the three months to August 2017 following a strong start to the year, marking the fourth consecutive fall in the three-month on three-month growth rate.

Leading the fall in the three months to August 2017 was private commercial new work, which fell by 2.9%. Private commercial has been on a decline in recent months following a period of steady growth since mid-2012, indicating there may be emerging signs of a slowdown in the sector (Figure 3). Figure 3 also highlights a decreasing growth contribution from public new work over the same period, falling from 0.3 percentage points to negative 0.4 percentage points.

Figure 3: Contributions to three-month on three-month growth in construction output

UK, January 2016 to August 2017

Source: Office for National Statistics

Notes:

- Contributions may not sum due to rounding.

Download this chart Figure 3: Contributions to three-month on three-month growth in construction output

Image .csv .xls7. Despite falls in recent months, economic confidence in the UK rises for the fourth consecutive quarter

Economic confidence in the UK economy rose for the fourth consecutive quarter in Quarter 3 (July to Sept) 2017, according to the European Commission’s monthly Economic Sentiment Indicator (ESI). The ESI is a weighted composite measure based on national surveys of confidence in the industrial, services, retail trade and construction sectors, as well as among consumers1. The UK ESI fell for the second consecutive month in September 2017, although the underlying trend shows a more positive picture. The positive gain in Quarter 3 2017 was led by improved confidence in production and retail trade, while confidence in the construction sector eased. Sentiment in the services sector and among consumers remained unchanged in the quarter.

Figure 4: Economic Sentiment Index and real gross domestic product growth

UK, Quarter 3 (July to Sept) 2005 to Quarter 3 2017

Source: European Commission and Office for National Statistics

Notes:

- An index of 100 represents the long-term average from 1990 to 2016

Download this chart Figure 4: Economic Sentiment Index and real gross domestic product growth

Image .csv .xlsNotes for: Despite falls in recent months, economic confidence in the UK rises for the fourth consecutive quarter

- The ESI is computed with the following sector weights: industry 40%, services 30%, consumers 20%, construction 5%, and retail trade 5%.

8. London has seen weaker average house price growth than the UK as a whole since December 2016

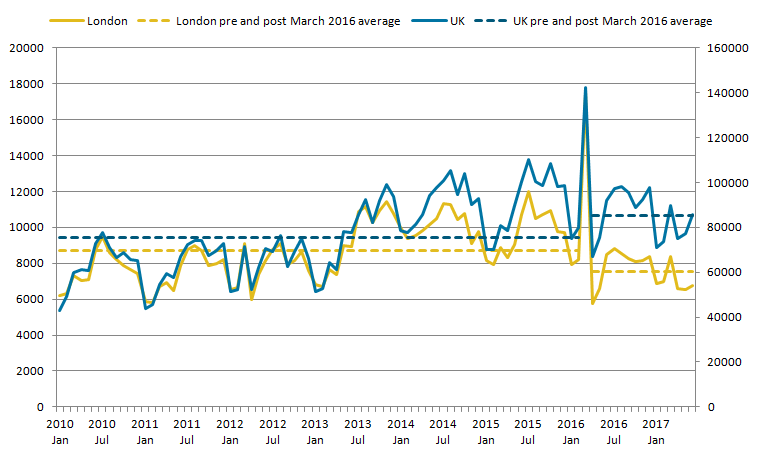

Figure 5 shows the 12-month growth rate in the UK House Price Index for London and the UK as a whole from January 2010 to August 2017. Since December 2016, average house price growth in London has been consistently lower than average house price growth across the UK, but this follows a sustained period of above UK average house price growth throughout the period from 2010. In particular, the fall in house price growth between March 2016 and March 2017 was considerably steeper in London than in the UK as a whole.

Figure 5: 12-month average house price growth rates, London and UK

January 2010 to August 2017

Source: UK House Price Index, Office for National Statistics

Download this chart Figure 5: 12-month average house price growth rates, London and UK

Image .csv .xlsIt should be noted however that, in levels terms, average house prices in London remain considerably higher than the UK average, with recent slowing growth representing only a modest fall back in the long-term upward trend (Figure 6). Since January 2010, average house prices across the UK have risen by around 35% compared with a rise of around 73% seen in London over the same period. London house prices are, on average, now more than twice the average UK price, with the ratio having been 1.7 times the UK average in January 2010, rising to 2.2 in March 2016 and since falling back slightly to 2.1 in August 2017.

Figure 6: Average house prices, London and UK

January 2010 to August 2017

Source: UK House Price Index, Office for National Statistics

Download this chart Figure 6: Average house prices, London and UK

Image .csv .xlsData on the volume of sales in the UK and London show that both saw a spike in transactions in March 2016, as also noted in previous analysis, immediately prior to the introduction of higher Stamp Duty charges on second properties, followed by a sharp fall when the changes came into force in April 2016 (Figure 7). However, the fall was more pronounced in London than in the UK as a whole. The level of transactions in London has remained relatively subdued relative to average pre-March 2016 levels during the rest of 2016 and into 2017, with the average sales volumes in London since March 2016 being lower than the average sales volumes from January 2010 to March 2016, while the reverse is true for the UK as a whole.

The Council of Mortgage lenders reports in September 2017 that housing market activity has been shifting away from buy-to-let purchases – which would typically be second properties and subject to the new higher Stamp Duty – and more towards first-time buyers. As London has historically had a relatively high proportion of second properties, including rental properties, this reduced demand could partly explain the observed fall in house price growth.

Figure 7: Volume of sales, London and UK

January 2010 to June 2017

Source: UK House Price Index, Office for National Statistics

Download this image Figure 7: Volume of sales, London and UK

.png (39.0 kB) .xls (38.9 kB)9. UK unemployment rate remains at its lowest since 1975

Latest estimates from the Labour Force Survey show that the UK unemployment rate declined by 0.2 percentage points to 4.3% in the three months to August 2017 compared with three months ago. The employment rate increased by 0.2 percentage points to 75.1% in the three months to August 2017 compared with three months ago. The latest period during which the employment rate matched the pre-economic downturn average of 72.8% was May to July 2014, and since then the employment rate has been outperforming its pre-downturn average. The unemployment rate has been outperforming its pre-economic downturn average of 5.1% since February to April 2016.

The number of people in work increased by 94,000 in the three months to August 2017 compared with three months ago. In the three months to August 2017, there were 78,000 more women in employment compared with three months ago. Full-time employment increased by 25,000 to 23.56 million in the three months to August 2017 compared with the previous quarter, whereas part-time employment increased by 69,000 to 8.55 million over the same period. In the three months to August 2017, the number of self-employed workers increased by 57,000 to reach a record high level of 4.86 million, whereas the number of employees increased by 39,000.

An increase in the total employment level was accompanied by a decrease in the total unemployment level by 52,000 in the three months to August 2017, when compared with the previous quarter. In the three months to August 2017, the inactivity rate declined marginally to 21.4% when compared with the previous quarter. The inactivity level for those aged 16 to 64 years decreased by 17,000 on the quarter to 8.81 million, driven by falls in economic inactivity amongst three older age groups: 25 to 34, 35 to 49 and 50 to 64.

Real wages continue to fall

Figure 8: Regular average weekly earnings growth, real and nominal

Great Britain, seasonally adjusted, three month on three month a year ago, August 2006 to August 2017

Source: Office for National Statistics, Monthly Wages and Salaries Survey

Notes:

- CPIH is the rate of Consumer Prices Index inflation including owner occupiers’ housing costs. It is shown as negative here to demonstrate the impact it has on real wages.

Download this chart Figure 8: Regular average weekly earnings growth, real and nominal

Image .csv .xlsNominal average weekly earnings for employees in Great Britain increased by 2.2% including bonuses in August 2017, and by 2.1% excluding bonuses compared with a year earlier. In real terms, average weekly earnings fell by 0.4% on the previous year (excluding bonuses) and by 0.3% (including bonuses). The recent fall (since the three months to March 2017) in real wages is due to higher rates of inflation, which has outpaced nominal wage growth.

In February 2017, the annual rate of Consumer Prices Index including owner occupiers’ housing costs (CPIH) inflation rose above 2.0% and increased to 2.7% in August 2017. From October 2013 to February 2017, the annual rate of CPIH inflation was not higher than 2.0% and real wage growth reached a peak of 2.6% in July 2015 (Figure 8).

Labour market flows

Recent analysis examined gross and net flows, hazard rates (transition probabilities) and job-to-job moves to get a more detailed understanding of the movements that underlie headline labour market statistics. This analysis also linked long-term trends in flows to economic cycles to establish whether certain flows follow a cyclical pattern.

The numbers of people in employment, unemployed and economically inactive in the UK show relatively small changes from quarter to quarter. However, these changes are the net effect of large numbers of people moving between different labour force categories, most notably the three economic activity groupings of employment, unemployment and inactivity.

Figure 9: Quarterly flows across UK labour market

UK, seasonally adjusted, January to March 2017 to April to June 2017

Embed code

Figure 9 shows estimated gross flows, that is, the total inflow or outflow for working age employment, unemployment and inactivity from one calendar quarter to the next. The period covers January to March 2017 (Quarter 1) and April to June 2017 (Quarter 2). Approximately 3.22 million people move across the labour market either by moving from one pool to another or changing employment every quarter. More people left inactivity (937,000) than any other stock. The number of people who moved from inactivity to employment was 540,000. This was higher than those who moved from unemployment to employment, which was 439,000. Comparing these gross flows with the published quarterly changes in the headline Labour Force Survey aggregates reveals how substantial the underlying movements hidden behind these values are.

Figure 10: Comparison of four-quarter moving average of flows as a percentage of working age population

UK, seasonally adjusted, April to June 2003 to April to June 2017

Source: Office for National Statistics, Labour Force Survey

Notes:

- We use a four-quarter moving average to adjust for volatility in the series.

Download this chart Figure 10: Comparison of four-quarter moving average of flows as a percentage of working age population

Image .csv .xlsFigure 10 compares four-quarter moving average flows as a percentage of working age population since April to June 2003 with the latest available period (April to June 2017). In the three months to June 2017, on average 459,000 people (1.12% of the working age population) moved from unemployment to employment every three months, whereas 290,000 people (0.70% of the working age population) moved from employment to unemployment, the lowest since the earliest comparable period in 2001.

Flows from employment to unemployment as a four-quarter moving average have been falling since July to September 2016. This means that not only are there more people in work (higher employment levels) as per published Labour Force Survey indicators, but on average a record low level of employed people are transiting into the unemployed category.

In the three months to June 2017, on average 544,000 people (1.32% of the working population) moved from inactivity to employment every quarter, whereas on average 567,000 people (1.38% of the working population) every quarter moved in the other direction – from employment to inactivity (Figure 10). The gross outflow from employment was 797,000 in the three months to June 2017; this is lower when compared with the same period in 2015, which was 901,000. In fact, this gross outflow from employment is at its lowest since the three months to March 2006. Recently, the flows from employment to unemployment and vice versa have fallen by a larger proportion compared with the other flows (Figure 10).

Back to table of contents