Table of contents

- Main points

- Introduction

- A Cluster Analysis of the variables included in the Tourism Atlas

- A focus on Cluster 4 and 5 – ‘holiday hotspots’

- Cluster Analysis of the Themes of data covered in the Tourism Atlas

- Factor Analysis to reduce the number of variables

- Methodology – Background Information

- Background notes

1. Main points

Analysis on variables in the Atlas of Tourism produced 5 distinct groupings of counties and unitary authorities based upon similarities in their tourism characteristics

Two groups, comprising of 31 geographical areas, have been classified as areas where tourism visits for holiday purposes are important, referred to as ‘holiday hotspots’

Key characteristics of ‘holiday hotspots’ are: higher proportions of jobs in accommodation for visitors, higher percentages of main jobs in tourism and tourism enterprises and higher percentages of inbound trips for a holiday purpose

2. Introduction

The analysis presented here has been performed to explore the data contained in the Atlas of Tourism in further detail. The purpose of this analysis is to assess the possibility of grouping areas (county and unitary authority level) that have similar tourism characteristics to determine if it is feasible to construct a spatial classification based on these characteristics. The ultimate aim is to test a methodology (using data from the Atlas of Tourism) which aims to provide a useful tool for policy makers in identifying areas that share similar characteristics in terms of tourism.

It is not being suggested that the grouping of areas represents a measure of tourism importance, for example it is not being said that tourism is more important in one cluster and less in another. The analysis simply allows for the differing tourism characteristics that areas have, for example a focus on holiday trips with high levels of nights per trip, or a propensity towards shorter breaks, or business tourism. The aim is therefore to highlight areas that share similar characteristics.

There are 411 variables in the Atlas of Tourism and 171 out of 411 were selected for further analysis based on certain criteria; please see methodology for details on the criteria used. The only additional variable used in the analysis is the Rural Urban Classification (RUC) for the geographical locations; please see methodology for more details. The 171 Atlas of Tourism variables are divided into four themes: employment and industry; domestic day visits; domestic overnight tourism; and inbound tourism. The RUCs are included in each theme.

The analysis followed a number of clear stages:

A cluster analysis has been performed for each theme in the Atlas of Tourism,

A factor analysis was then performed on all the variables across the 4 themes to reduce the number of variables into 4 factors,

A final cluster analysis was performed on the variables contained in the 4 factors. The final cluster analysis provides us with fivefold classification of the counties and unitary authorities of England and Wales, based on the characteristics of tourism within each area.

This article first presents the final cluster analysis in some detail as it represents the main output from the analysis. The article also includes the cluster analysis for each of the 4 themes and the factor analysis procedure.

The Atlas of Tourism

The Atlas of Tourism is an interactive tool that has been created to provide official statistics to tourism officials, to help them understand the impact of tourism within their local area (at county and unitary authority level), in England and Wales. There are tourism statistics and contextual data for all of the 174 different counties and unitary authorities available within the Atlas.

The tool offers the ability to view the data in chart, map and table form. It enables comparison between different geographical locations on a range of different variables that can be specified by the user. The Tourism Atlas was released on 16 April 2015 and can be accessed on the Neighbourhood Statistics website.

Back to table of contents3. A Cluster Analysis of the variables included in the Tourism Atlas

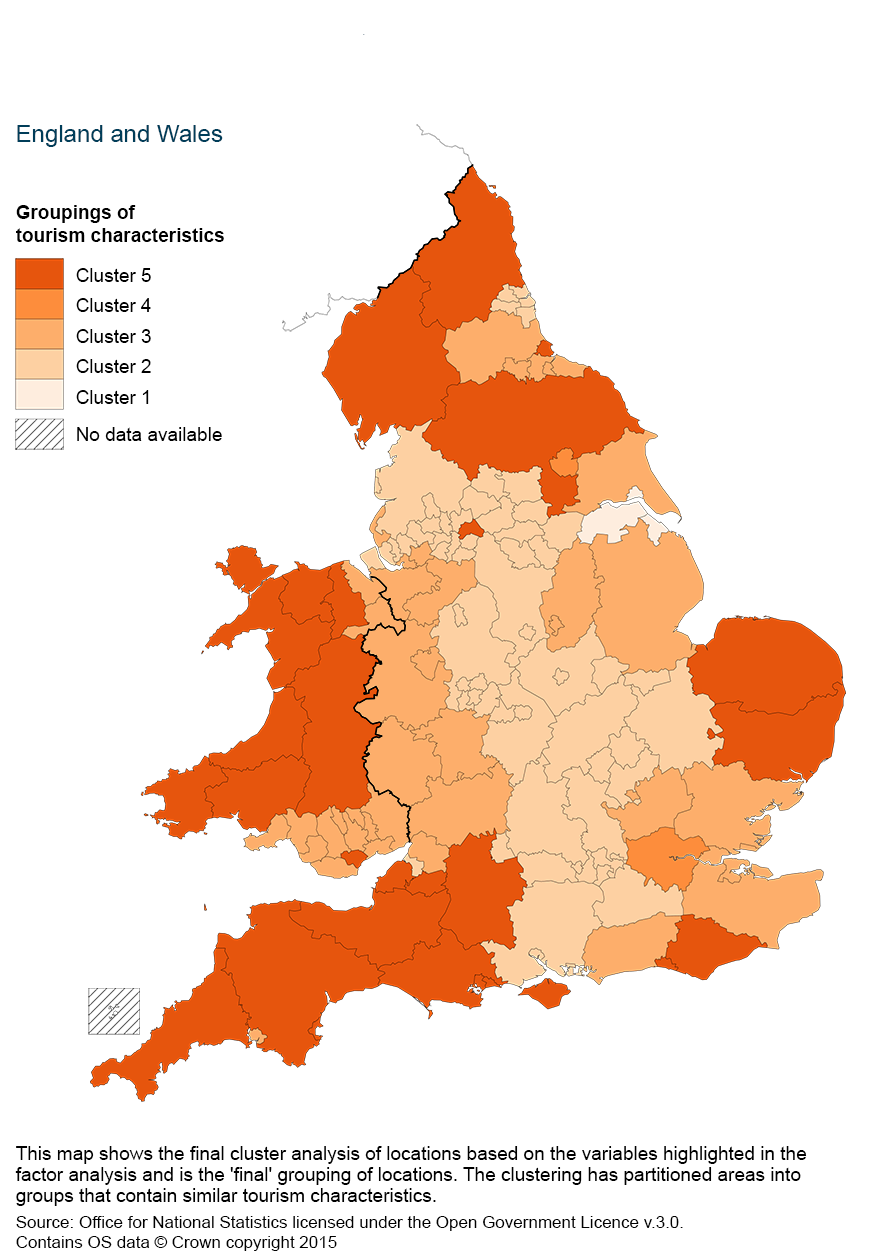

This section describes the main outcome of this analysis: a grouping of the counties and unitary authorities in England and Wales into 5 clusters, based on similar tourism characteristics. The clusters are shown in the map and the summary characteristics of each cluster are shown in the table below.

Map 1: Final cluster analysis showing areas that share similar tourism characteristics by county and unitary authority, 2011 to 2013

Download this image Map 1: Final cluster analysis showing areas that share similar tourism characteristics by county and unitary authority, 2011 to 2013

.png (339.2 kB)

Table 1: Description of the five clusters

| Cluster No. | Geographical Description | Summary of characteristics | No. UAs/ Counties |

| Cluster 1 | Kingston upon Hull; City of, North East Lincolnshire and North Lincolnshire. | The smallest cluster which is characterised by higher than average inbound visits for purposes other than business, holiday, or visiting friends and relatives (VFR). The cluster does not share the characteristics of areas where holiday, VFR and business trips (overnight or day visit) are more prevalent. | 3 |

| Cluster 2 | Northern and mid England urban areas, urban areas to the west of London and some larger counties throughout the Midlands and South England. | This cluster is dominated by inbound tourism characteristics, including higher % of nights stayed and expenditure by Asian and African tourists, and higher % of nights stayed and expenditure on studying by all inbound visitors. This cluster highlights the study purpose of trip from overseas visitors. | 65 |

| Cluster 3 | South, South-East and North-East Wales (excluding Cardiff), Mid-West England, North-East England, East Riding of Yorkshire, locations bordering North-West to South-East of London, West Sussex and Plymouth. | This cluster has the following characteristics; higher % age 16-19 tourism workers, also as main job; higher % 65-69 year olds in tourism as main job; higher % day visits with the purpose of exploring an area; higher % trips 4-7 nights for holiday and business, higher % nights stayed and expenditure by European visitors. This cluster, therefore, has tourism importance shown in terms of certain types of day visit, domestic overnight and inbound tourism. | 42 |

| Cluster 4 | Greater London and York | This cluster has high percentage of holiday trips of length 1-3 nights, a characteristic of urban tourism. Inbound tourists also have a much higher percentage of expenditure on holidays and domestic tourists have a higher expenditure per trip ratio, again consistent with urban tourism. There is a higher than average % of nights stayed for holiday purposes, compared to business, studying, VFR or ‘other’ trips, by all inbound visitors. Tourism is also important in this cluster in terms of the tourism economy with a higher % tourism enterprises; a higher % of tourism workers are aged 30 to 39; a higher % of workers have a degree or higher education qualification, and a higher % workers in England and Wales age 25 to 64 are working in the tourism industry. | 34 (including 33 London boroughs) |

| Cluster 5 | Mid, North and West Wales, South West England, with parts of East Anglia, the North, the Isle of Wight and East Sussex. | Cluster 5 is characterised by higher % jobs in accommodation for visitors; higher % day visits for outdoor leisure activities and exploring an area; higher % 16 to 19 workers in the tourism industry; higher % nights stayed and expenditure by European inbound visitors; higher % holiday and VFR length 4-7 nights; higher nights per trip ratio; and higher % nights stayed and expenditure on holidays. There is a higher than average expenditure per trip. This cluster is characterised, therefore with holiday and outdoor activity in keeping with the geographical areas covered. | 29 |

| Source: Office for National Statistics | |||

Download this table Table 1: Description of the five clusters

.xls (28.7 kB)Cluster 1 is an unusually small cluster. Exploring the data further reveals that they have the exactly the same value observations for variables relating to inbound tourism (IPS survey data, probably as a result of low sample sizes at county or unitary authority level). They are all located around the River Humber and border each other which could also explain or corroborate the similarities in tourism characteristics.

The areas in cluster 2 have a higher percentage of nights spent and expenditure on studying by all inbound visitors and from further research it can be seen that a lot of the locations have higher education institutes (that is universities), suggesting that studying is of value in attracting international visitors to these areas. The study purpose of trip qualifies as tourism in a definitional sense, although it is not normally closely related with ‘tourism’.

Cluster 3 contains locations with characteristics which suggest that tourism is of importance, shown in the above average percentages of domestic trips length 4 to 7 nights for holiday and business purposes, higher percentage of day visits spent exploring an area and higher percentage of workers employed in the tourism industry in for some age categories.

The locations in cluster 4, Greater London and York, are both recognised tourism destinations and it is evident from the characteristics relating to tourism workers and enterprises (see above table) that tourism is important to the economy in York and Greater London. Characteristics of urban tourism are also evident by the higher percentage of holiday’s length 1 to 3 nights (suggesting tourists prefer city breaks to these locations rather than longer stays), a much higher expenditure on holidays by inbound tourists and higher expenditure per trips ratio by domestic tourists. There is also an above average percentage of nights stayed for a holiday purpose by all inbound visitors (American – North and South, European, Asian, African, Australasian). Therefore, it can be seen that tourism with a holiday purpose is both popular and highly important in York and Greater London, so they are labelled as ‘holiday hotspots’.

Most locations within cluster 5 are rural and/or coastal, the more traditional holiday destinations in England and Wales. The importance of tourism to the economy in these locations is evident through the higher percentage of workers age 16-19 and 25-64 within the tourism industries and the higher than average percentage of tourism enterprises in these areas.

Two locations, Hartlepool and Oldham, do not conform to the patterns of other cluster 5 locations. From further exploration of the data for these locations, it is clear that there are low sample sizes in these areas across the different surveys and results are skewed as a result. This is a limitation in using disaggregated survey data within the analysis. There appears to be a lower percentage of nights stayed and expenditure on holidays in comparison with the rest of cluster five, both are more urban, there are a lower percentage of jobs in accommodation for visitors and a higher percentage of jobs in food and beverage serving activities. These are all suggestive that tourism is not as prominent for Hartlepool and Oldham as the clustering would indicate.

Within cluster 5 there is a higher percentage of nights stayed for holiday and VFR purposes (compared to business, studying or ‘other’ purposes), which is mostly consistent for inbound visitors from all continents. Also, there is a higher than average expenditure per trip, which in rural areas would imply longer stays (on holidays, for example) and a higher percentage of jobs in accommodation for visitors. There are also higher percentages of day visits spent exploring an area or participating in an outdoor leisure activity, also both tourist and holiday activities. Similarly to cluster 4, tourism with a holiday purpose is both prevalent and of high importance in these locations, so the areas in cluster 5 are also labelled as ‘holiday hotspots’.

Back to table of contents4. A focus on Cluster 4 and 5 – ‘holiday hotspots’

The final cluster analysis has highlighted 31 locations in England and Wales which are classified as ‘holiday hotspots’. In this section the characteristics of these locations (present in clusters 4 and 5) are explored in further detail.

Figure 1 shows the percentage of first and second jobs in each location that are in the following tourism characteristic industries: accommodation for visitors; food and beverage serving activities; passenger transport, travel agencies, vehicle hire etc; and cultural, sports, recreational and conference activities. The England/Wales averages are shown in Table 2, along with the averages for ‘holiday hotspots’. Generally, areas within cluster 4 or 5 have an above percentage of jobs within the accommodation for visitors sector. Pembrokeshire has the highest percentage of jobs in accommodation for visitors (36.4%) and Brighton and Hove has the lowest (6.3%). There are, however, 4 areas with below average percentage jobs in accommodation for visitors: Cardiff, Greater London, Oldham and Brighton and Hove.

Figure 1: The percentage of jobs in the four different tourism industry sectors, for locations in clusters 4 and 5

Source: Annual Population Survey (APS) - Office for National Statistics

Download this chart Figure 1: The percentage of jobs in the four different tourism industry sectors, for locations in clusters 4 and 5

Image .csv .xls

Table 2: The percentage of jobs in the four different tourism industry sectors, comparing the ‘holiday hotspot’ and England/Wales average

| Industry | ‘Holiday hotspot’ average | England/Wales average |

| Accommodation for visitors | 20.25 | 11.72 |

| Food and beverage serving activities | 42.26 | 45.52 |

| Passenger transport, travel agencies, vehicle hire etc | 12.98 | 17.91 |

| Cultural, sports, recreational and conference activities | 24.52 | 28.42 |

| Source: Office for National Statistics | ||

Download this table Table 2: The percentage of jobs in the four different tourism industry sectors, comparing the ‘holiday hotspot’ and England/Wales average

.xls (32.3 kB)Figure 2 shows the percentage of enterprises in tourism and the percentage of main jobs in tourism industries. Holiday destinations might be expected to have higher percentages of both of these. The England/Wales averages are shown in Table 3, along with the averages for areas included in cluster 4 and 5. As shown, Gwynedd has the highest percentage of main jobs in tourism (14.9%) followed by the Isle of Anglesey (14.0%) with Oldham having the least (7.3%). Torbay has the highest percentage of tourism enterprises (16.2%) followed by the Isle of Wight (15.5%) with Poole the lowest of these areas (8.0%).

Figure 2: The percentage of main jobs in the tourism industry and the percentage of tourism enterprises, for locations in clusters 4 and 5

Source: Annual Population Survey (APS), Inter Departmental Business Register (IDBR) - Office for National Statistics

Download this chart Figure 2: The percentage of main jobs in the tourism industry and the percentage of tourism enterprises, for locations in clusters 4 and 5

Image .csv .xls

Table 3: The percentage of main jobs in the tourism industry and the percentage of tourism enterprises, comparing the ‘holiday hotspot’ and England/Wales average

| ‘Holiday hotspot’ average | England / Wales average | |

| % main jobs in tourism | 10.48 | 8.65 |

| % tourism enterprises | 11.31 | 10.31 |

| Office for National Statistics | ||

Download this table Table 3: The percentage of main jobs in the tourism industry and the percentage of tourism enterprises, comparing the ‘holiday hotspot’ and England/Wales average

.xls (32.3 kB)Figure 3 shows that there is variation in the overall ‘holiday destination’ focus of these areas, and the type of tourism profile can differ across the areas for particular variables. This is evident in the length of holiday taken by domestic overnight tourists. For example, Cardiff, Greater London and York have the highest percentage of stays length 1-3 nights (89.4%, 86.7%, and 84.2% respectively) which is typical of tourism in urban areas, largely made up of weekend trips or city breaks. On the other hand, the Isle of Wight, Cornwall and Devon have the highest percentage of stays length 4-7 nights (52.8%, 51.6% and 48.0% respectively) and Oldham, Cornwall and Ceredigion have the highest percentage of stays length 8+ nights (33.3%, 16.4% and 13.2% respectively). The England/Wales averages are shown in the below table, along with the averages for areas classified as ‘holiday hotspots’. Comparing these averages, it can be seen that in these areas the % length of stays of 1-3 nights are lower, suggesting longer stays are characteristic of holiday destinations.

Figure 3: The percentage of domestic holidays by specified length, for locations in clusters 4 and 5

Source: Visit England, Visit Wales, Visit Scotland

Notes:

- Survey used: Great Britain Tourism Survey.

Download this chart Figure 3: The percentage of domestic holidays by specified length, for locations in clusters 4 and 5

Image .csv .xls

Table 4: The percentage of domestic holidays by specified length, comparing the ‘holiday hotspot’ and England/Wales average

| % holidays length: | ‘Holiday hotspot’ average | England/Wales average |

| 1-3 nights | 56.33 | 72.60 |

| 4-7 nights | 35.91 | 21.32 |

| 8+ nights | 7.75 | 6.08 |

| Source: Office for National Statistics | ||

Download this table Table 4: The percentage of domestic holidays by specified length, comparing the ‘holiday hotspot’ and England/Wales average

.xls (32.3 kB)Figure 4 shows the percentage of nights stayed by inbound tourists by purpose: holiday, business, studying, VFR and ‘other’. The England/Wales averages are shown in the below table, along with the averages for areas classified as ‘holiday hotspots’. The table below shows that the average of percentage nights stayed on holidays is above average in these locations (as would be expected in holiday destinations) and despite the average stays for VFR purpose is higher in these areas, it is below the England/Wales average. Cornwall has the highest percentage of visits for a holiday (61.4%) followed by Pembrokeshire (57.9%) and the Isle of Anglesey (53.3%). There are six areas within clusters 4 and 5 that are below average in the percentage of nights stayed on holiday: Oldham, 17.4%; Suffolk, 18.3%; Wiltshire, 18.7%; Norfolk, 19.6%; Hartlepool, 19.8%; and Northumberland, 20.9%.

Figure 4: The percentage of nights stayed by inbound tourists by purpose for locations in clusters 4 and 5

Source: International Passenger Survey (IPS) - Office for National Statistics

Download this chart Figure 4: The percentage of nights stayed by inbound tourists by purpose for locations in clusters 4 and 5

Image .csv .xls

Table 5: The percentage of nights stayed by inbound tourists by purpose, comparing the ‘holiday hotspot’ and England/Wales average

| % nights stayed by inbound tourists by purpose | ‘Holiday hotspot’ average | England/Wales average |

| Holiday | 34.15 | 25.00 |

| Business | 8.58 | 13.45 |

| Studying | 11.52 | 11.02 |

| VFR | 39.93 | 43.04 |

| ‘other’ | 5.83 | 7.51 |

| Source: Office for National Statistics | ||

Download this table Table 5: The percentage of nights stayed by inbound tourists by purpose, comparing the ‘holiday hotspot’ and England/Wales average

.xls (32.3 kB)Figure 5 shows the average expenditure per day visit for the locations in clusters 4 and 5. Cardiff has the highest spend per day, with £50.08, and the Isle of Anglesey has the second highest, £48.92. The lowest average spend per day visit is Hartlepool, £16.96, then Oldham, £18.41. The average domestic day visit spend for Greater London is £38.04, which is £12.04 lower than Cardiff, but this is due to an average of all London Boroughs being included in the analysis and there will be large variations between London boroughs on this variable. Furthermore, it can be seen that 17 locations within clusters 4 and 5 fall below the average spend per day visit for England and Wales, which suggests this variable has some variation across holiday destinations.

Figure 5: The average expenditure per domestic day visit, for locations in clusters 4 and 5 (£s)

Source: VisitEngland, VisitWales, VisitScotland

Notes:

- Survey used: Great Britain Day Visits Survey

Download this chart Figure 5: The average expenditure per domestic day visit, for locations in clusters 4 and 5 (£s)

Image .csv .xls

Table 6: The average expenditure per domestic day visit, comparing the ‘holiday hotspot’ and England/Wales average (£'s)

| ‘Holiday hotspot’ average | England/Wales average | |

| Average expenditure per domestic day visit | £32.05 | £31.37 |

| Source: Office for National Statistics | ||

Download this table Table 6: The average expenditure per domestic day visit, comparing the ‘holiday hotspot’ and England/Wales average (£'s)

.xls (24.6 kB)5. Cluster Analysis of the Themes of data covered in the Tourism Atlas

A ‘k-means cluster analysis’ was performed on the four themes from the Atlas of Tourism across the counties and unitary authorities of England and Wales. This divides the geographical locations into groups based on similarities between the variables. The Isles of Scilly were excluded from the cluster analysis due to a significant number of missing or suppressed values. For further technical information see the methodology section of this article.

To allow for an overall picture of tourism in London, the observations for each borough were aggregated and a value for Greater London produced for each variable. This avoided the problem of a high level of variability in the data for the London boroughs which had an adverse impact on the cluster analysis.

The Rural Urban Classification (RUC) of each location was included as a variable in the cluster analysis of each theme. The RUC of the counties and unitary authorities of England are based on 2011 census data and are awaiting publication. The RUC of the counties and unitary authorities of Wales were aggregated from the RUC of wards, from ONS for 2011.

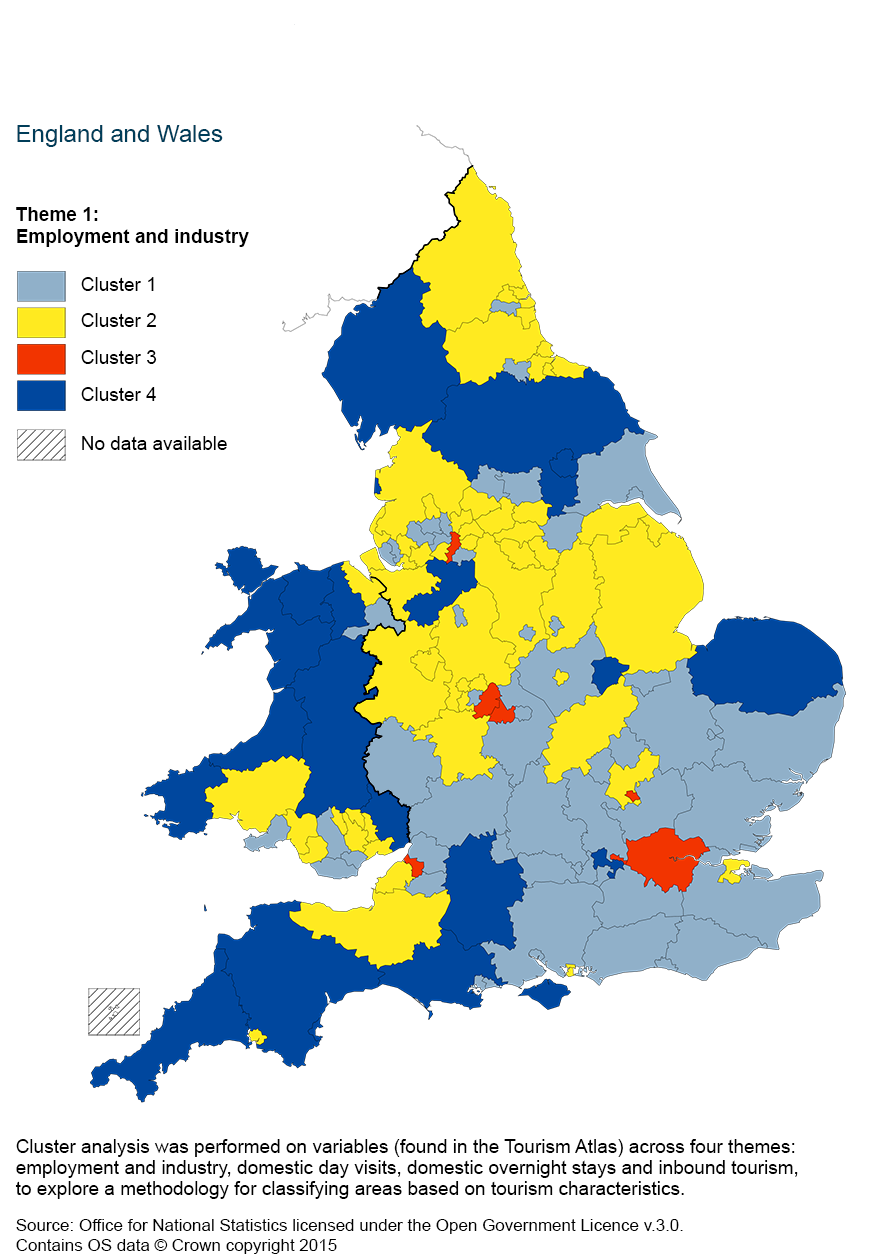

Theme 1: Employment and Industry

Theme 1 contains 39 variables that are taken from the Employment and Industry themes of the Atlas of Tourism using data from the Annual Population Survey and the Inter-Departmental Business Register. Using the k-means cluster analysis, the geographical areas are grouped into four clusters.

The variables in this theme are concerned with the characteristics of tourism workers (age, qualification level) and the jobs in the industry (sector breakdown, number of main and second jobs available in tourism, percentage of tourism enterprises).

Map 2: Cluster analysis of employment and industry, using a four cluster classification by county and unitary authority, 2011 to 2013

Download this image Map 2: Cluster analysis of employment and industry, using a four cluster classification by county and unitary authority, 2011 to 2013

.png (336.4 kB)

Table 7: Cluster information for theme one (including characteristics of each cluster and summary of geographical areas covered, number of members in each cluster)

| Cluster number | Cluster characteristics | |

| 1 (contains 55 locations) | Higher % of jobs in passenger transport, travel agencies, vehicle hire etc., cultural, sport, recreation and conference activities. Higher % of jobs in tourism industry for 65-69 and average % for 20-24 year olds. Higher % of main jobs in tourism for 16-24 and 60-69 year olds. Average % of main jobs in tourism for 45-49. Higher % workers with GCE and GCSE level or equivalent qualifications. Lower % for all other levels (degree, higher education, other, no, unsure of). Lower % of main jobs in tourism for others. Lower % of jobs in tourism industry for 16-19 and 25-64 and 70+ year olds. Lower % of main and second jobs in tourism. Lower % of tourism enterprises. Lower % of jobs in accommodation for visitors and food and beverage serving activities. RUC 4 - urban. | |

| 2 (contains 57 locations) | Higher % of jobs in the food and beverage service activities. Lower % of jobs in accommodation for visitors, cultural, sport, recreation and conference activities, passenger transport, travel agencies, vehicle hire etc.. Higher % of workers in tourism industries 16-19. Lower % of workers in tourism industries aged 20-69. Average % of workers in tourism industries aged 70+. Higher % of tourism workers age 16-24 and 50-59. Lower % of tourism workers age 25-49 and 60+. Lower % of workers with degree, higher education, other level qualifications (or equivalent). Higher % of workers with GCE, GCSE, no or unsure of level (or equivalent). Lower % of main jobs in tourism. Higher % of second jobs in tourism. Lower % of tourism enterprises. RUC 4 - urban. | |

| 3 (contains 39 locations including 33 London boroughs) | Lower % of jobs in accommodation for visitors and food and beverage service activities. Higher % of jobs in passenger transport, travel agencies, vehicle hire etc.; cultural, sport, recreation and conference activities. Lower % of 16-24 and 65-69 year olds in tourism industry. Higher % of 25-64 and 70+ year olds in tourism industry. Lower % of tourism workers aged 16-24 and 50+. Higher % of tourism workers aged 25-49. Higher % of workers with degree, higher education or ‘other’ level or equivalent qualification. Lower % of workers with GCE, GCSE, no or ‘unsure of’ level (or equivalent). Higher % of main jobs in tourism. Lower % of second jobs in tourism. Higher % of tourism enterprises. RUC 6 - urban. | |

| 4 (Contains 22 locations) | Higher % of jobs in accommodation for visitors. Lower % of jobs in food and beverage serving activities, passenger transport, travel agencies, vehicle hire etc., cultural, sport, recreation and conference activities. Higher % of jobs in tourism industry for all ages. Higher % of tourism workers age 16-19 and 45+. Average % of tourism workers age 20-24. Lower % of tourism workers age 25-44. Lower % of workers with degree or equivalent, ‘other’ and no level qualifications. Higher % of workers with higher education, GCE or GCSE level or equivalent qualification. Average % of workers ‘unsure’ of qualification level. Higher % of main and second jobs in tourism. Higher % of tourism enterprises. RUC 2 - rural. | |

| Missing | 1: Isles of Scilly |

Download this table Table 7: Cluster information for theme one (including characteristics of each cluster and summary of geographical areas covered, number of members in each cluster)

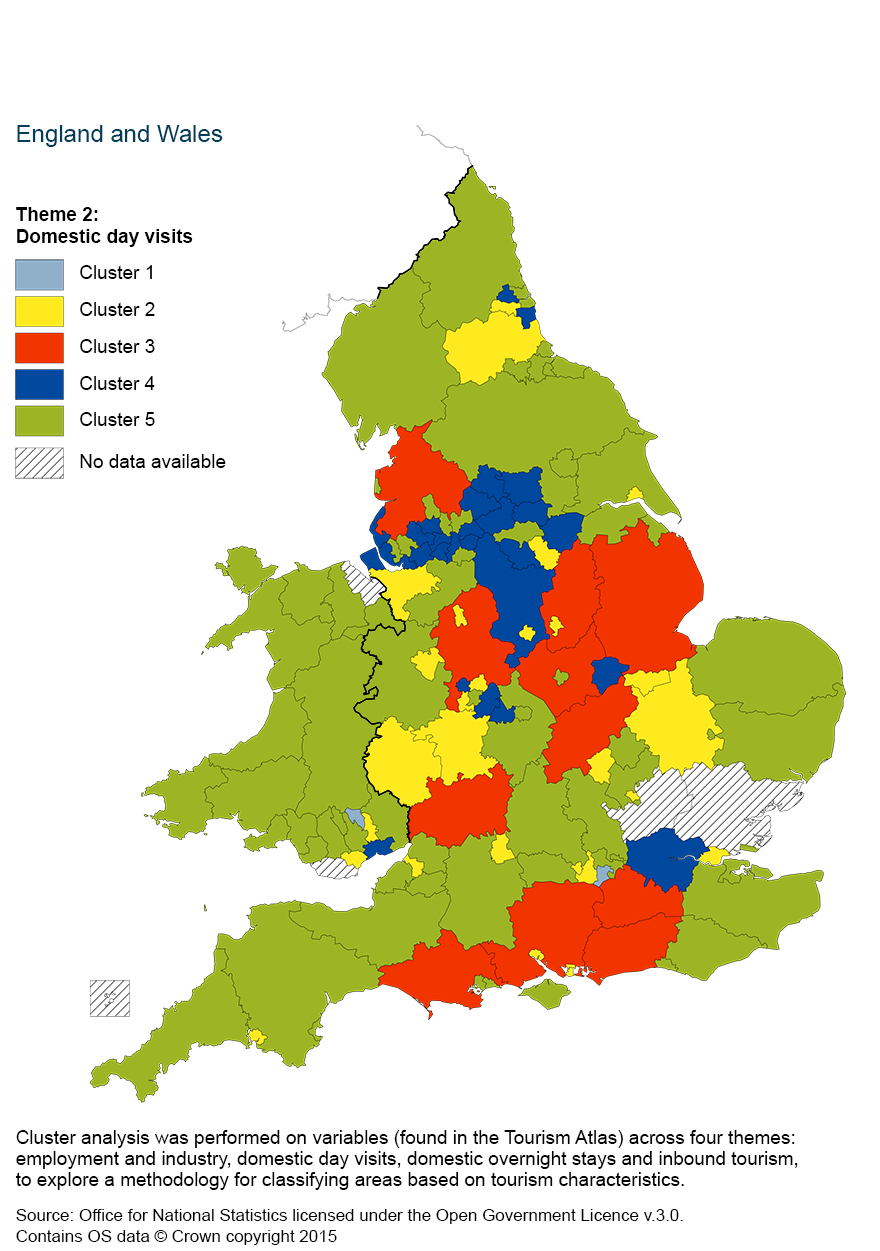

.xls (35.8 kB)Theme 2: Domestic Day Visits

Domestic day visits are visits by a UK resident to another UK location outside of their usual environment for a minimum of 3 hours, who returns to their usual environment (residence or workplace) the same day.

Theme 2 contains 42 variables from the Atlas of Tourism, originating from the Great Britain Day Visits Survey (averaged data from 2011-2013). Using the k-means cluster analysis, the geographical areas are grouped into five clusters.

The variables included in this theme are the ratio of expenditure to number of day visits, the % of day visits and expenditure of specified length (3-3.59, 4-4.59, 5-5.59 and 6+ hours), breakdown of the number of visits and expenditure by 16 specific purposes.

Map 3: Cluster analysis of day visits, using a five cluster classification by county and unitary authority, 2011 to 2013

Download this image Map 3: Cluster analysis of day visits, using a five cluster classification by county and unitary authority, 2011 to 2013

.png (330.2 kB)

Table 8: Cluster information for Theme Two (including characteristics of each cluster and summary of geographical areas covered, number of members in each cluster)

| Cluster number | Cluster characteristics | |

| 1 (contains 2 locations) | Higher ratio of total expenditure attributed to day visits to the total number of day visits. Lower % of day visits and expenditure on visits of length 3-3.59 and 6+ hours. Higher % of day visits and expenditure on day visits of length 4-4.59 and 5-5.59 hours. Average % of day visits for: visiting friends and relatives (VFR) and special personal event. Higher % of day visits for: special shopping, entertainment, ‘other’ leisure activity, watching live sport and beauty/spa/healthcare. Lower % of day visits for: meal, night out, outdoor leisure activity, sports participation, visiting attractions, special public event, exploring an area, ‘other’ activity not mentioned and visits with a dual purpose. Higher % of expenditure for day visits with a special shopping purpose. All other expenditure is lower than average. RUC 4 - urban. | |

| 2 (contains 27 locations) | Lower ratio of total expenditure attributed to day visits to the total number of day visits. Lower % of day visits of length 3-3.59, 4-4.59, 5-5.59 hours. Higher % of day visits of length 6+ visits. Higher % of expenditure on day visits length 4-4.59, 5-5.59 and 6+ hours. Lower % of expenditure on day visits length 3-3.59 hours. Higher % of day visits for: VFR, meal, night out, outdoor leisure activity, and average % for a dual purpose visit. Lower % of day visits for: special shopping, entertainment, ‘other’ leisure activity, sports participation, watching live sport, visiting an attraction, exploring an area, special public event, special personal event, beauty/spa/healthcare and ‘other’ leisure activity not mentioned. Higher % of expenditure on day visits for: VFR, meal, night out, exploring an area. Lower % of expenditure on day visits for: special shopping, entertainment, outdoor leisure activity, ‘other’ leisure activity, sports participation, watching live sports, visiting attractions, special public/personal events, beauty/spa/healthcare, ‘other’ activity not mentioned and visits with a dual purpose. RUC 3 - urban. | |

| 3 (contains 11 locations) | Higher ratio of total expenditure attributed to day visits to the total number of day visits. Higher % of day visits of length 3-3.59 and 4-4.59 hours. Average % of day visits of length 5-5.59 hours. Lower % of day visits of length 6+ hours. Higher % of expenditure for 3-3.59 and 6+. Lower % of day visits length 4-4.59 and 5-5.59 hours. Higher % of day visits for: night out, entertainment, sport participation, watching live sports, special public and personal event, beauty/spa/healthcare. Average % of day visits for: ‘other’ leisure and dual purpose visit. Lower % of day visits for: VFR, special shopping, meal, outdoor leisure activity, visiting attractions, exploring an area and ‘other’ activity not mentioned. Higher % of expenditure for: night out, entertainment, ‘other’ leisure activity, sports participation, watching live sport, special public event, beauty/spa/healthcare. Average % of expenditure on: special personal event. Lower % of expenditure on: VFR, special shopping, meal, outdoor leisure activity, visiting attractions, exploring an area, dual purpose visit and ‘other’ activity not mentioned. RUC 6 - urban. | |

| 4 (Contains 60 locations including 33 London Boroughs) | Higher ratio of total expenditure attributed to day visits to the total number of day visits. Lower % of day visits for visits length 3-3.59 and 4-4.59 hours. Higher % of day visits of length 5-5.59 and 6+ hours. Lower % of expenditure on day visits 3-3.59, 5-5.59 and 6+ hours. Higher % of expenditure on day visits length 4-4.59 hours. Lower % of day visits for: VFR, special shopping, meal, night out, ‘other’ leisure, sports participation, beauty/spa/healthcare, exploring an area and ‘other’ activity not mentioned. Higher % of day visits for: entertainment, outdoor leisure activity, watching live sport, visiting an attraction, special public/personal event and visits with a dual purpose. Lower % of expenditure on day visits for: VFR, special shopping, meal, night out, entertainment, ‘other’ leisure activity, sports participation, watching live sport, special public event, beauty/spa/healthcare and ‘other’ activity not mentioned. Higher % of expenditure on day visits for: outdoor leisure activity, visiting an attraction, special personal event, exploring an area and a visit for a dual purpose. RUC 4 - urban. | |

| 5 (contains 69 locations) | Lower expenditure to number of day visits ratio. Higher % of day visits of length 6+ hours (hrs). Lower % of day visits of length 4-4.59 and 5-5.59 hours. Average % of day visits of length 3-3.59 hours. Higher % of expenditure on day visits length 5-5.59 hours. Lower % of expenditure on day visits length 3-3.59 and 4-4.59 hours. Average % of expenditure on day visits length 6+ hours. Lower % of day visits for: VFR, special shopping, meal, night out (PCB), entertainment, special public event. Higher % of day visits for: outdoor leisure, ‘other’ leisure activity, sports, visiting attractions, beauty/spa/healthcare, exploring an area, ‘other’, dual purpose visit. Average % of day visits for: live sport events and special personal event. Lower % of expenditure for: VFR, special shopping, night out, entertainment, sports, live sports, special public event, and beauty/spa/healthcare. Higher % of expenditure for: meal, outdoor leisure, ‘other’ leisure, visiting attractions, special personal event, exploring an area, ‘other’, dual purpose visit. Lower % of expenditure for: VFR, special shopping, night out (PCB), entertainment, other leisure activity, sports participation, watching a live sport, special public event, beauty/spa/healthcare. RUC 3 - urban. | |

| Missing | 5: Isles of Scilly, Essex, Hertfordshire; County of, Flintshire, Vale of Glamorgan | |

| Source: Office for National Statistics | ||

Download this table Table 8: Cluster information for Theme Two (including characteristics of each cluster and summary of geographical areas covered, number of members in each cluster)

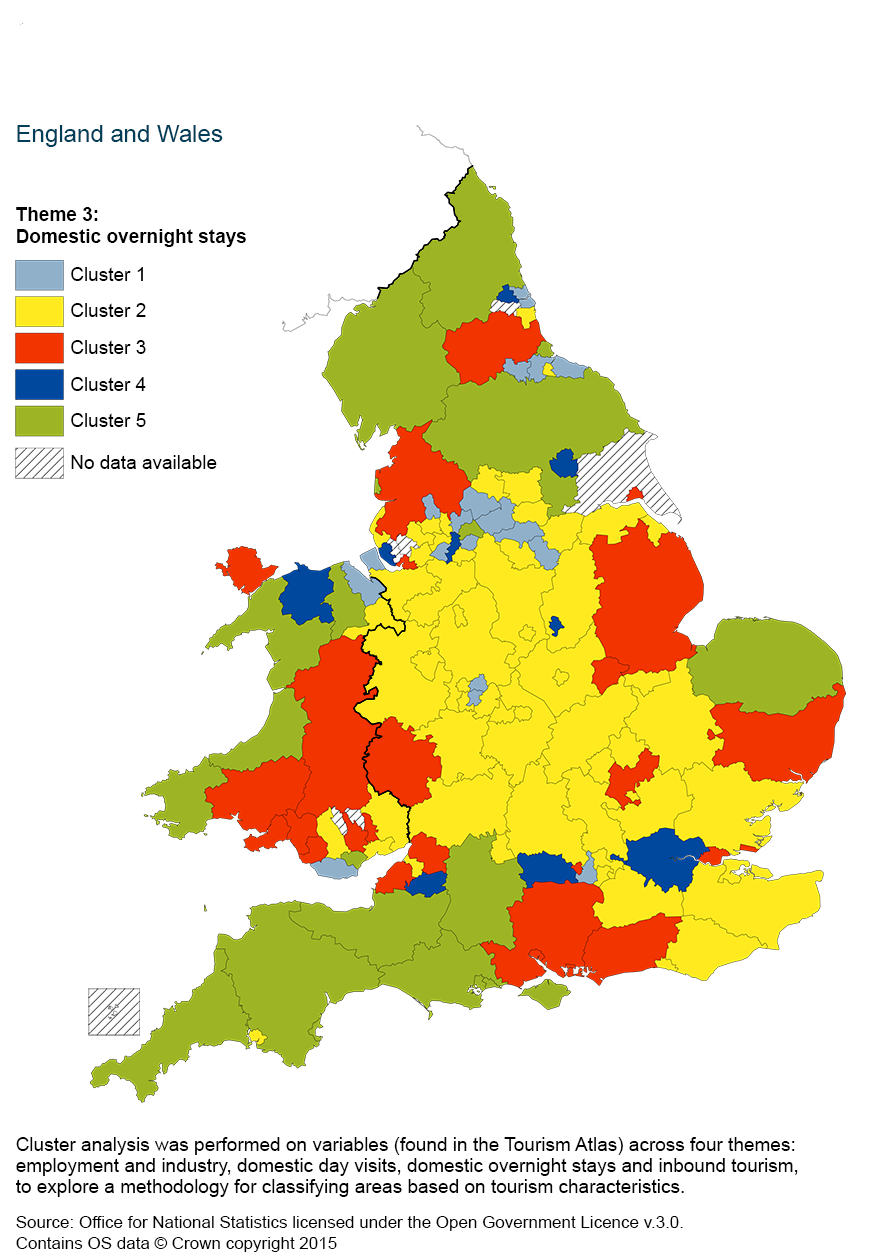

.xls (42.5 kB)Theme 3: Domestic Overnight Tourism

Domestic overnight tourism constitutes trips by UK residents to stay in a UK location for one or more nights. Data from the Great Britain Tourism Survey included in the Tourism Atlas is used in this theme (averaged data from 2011-2013).

Theme 3 contains 27 variables. Using the k-means cluster analysis, the geographical areas are grouped into five clusters.

The variables included in this theme are the ratio of the total number of nights to the total number of trips (giving the average number of nights per trip), the expenditure to total number of trips ratio (giving the average expenditure per trip), percentage of all trips and nights attributed to trips length 1-3, 4-7 and 8+ nights, percentage of trips and nights attributed to trips for the following three purposes: holiday, business and VFR of length 1-3, 4-7 and 8+ nights.

Map 4: Cluster analysis of domestic overnight stays, using a five cluster classification by county and unitary authority, 2011 to 2013

Download this image Map 4: Cluster analysis of domestic overnight stays, using a five cluster classification by county and unitary authority, 2011 to 2013

.png (335.6 kB)

Table 9: Cluster information for Theme Three (including characteristics of each cluster and summary of geographical areas covered, number of members in each cluster)

| Cluster number | Cluster characteristics | |

| 1 (contains 19 locations) | Lower ratio of the number of nights to the number of trips - for all overnight trips. Higher ratio of the expenditure (£mil) to number of all overnight trips (thousands). Higher % of trips of length 1-3 and 8+ nights. Lower % of trips of length 4-7 nights. Higher % of nights attributed to trips of length 1-3 nights. Lower % of nights attributed to trips of length 4-7 and 8+ nights. Higher % of holiday trips of length 1-3 nights. Lower % of holiday trips of length 4-7 and 8+ (also by nights attributed). Higher % of VFR trips of length 1-3 nights. Lower % of VFR trips of length 4-7 and 8+. By nights attributed, higher % of nights attributed to VFR trips of length 1-3 and 8+ nights. Lower % of nights attributed to VFR trips of length 4-7 nights. Higher % of business trips of length 1-3 nights. Lower % of business trips of length 4-7 nights. Average % of business trips of length 8+ nights. Higher % of nights attributed to business trips of length 1-3 and 8+ nights. Lower % of nights attributed to business trips 4-7 nights. RUC 6 - urban. | |

| 2 (contains 59 locations) | Lower ratio of the number of nights to the number of trips - for all overnight trips and ratio of the expenditure (£mil) to number of all overnight trips (thousands). Higher % of trips of length 1-3 nights. Lower % of 4-7 and 8+ nights (also by nights attributed). Higher % of holidays length 1-3 and 8+ trips. Lower % of 4-7 night trips. By nights attributed, higher % of nights attributed to holidays length 1-3 nights. Lower % of 4-7 and 8+ nights. Higher % of VFR trips of length 1-3 nights. Lower % of 4-7 and 8+ nights (also by nights attributed). Higher % of business trips of length 1-3 nights. Lower % of 4-7 nights. Average % of 8+ nights. By nights attributed, higher % of nights attributed to business trips of 1-3 nights. Lower % of 4-7 and 8+ nights. RUC 4 - urban. | |

| 3 (contains 26 locations) | Lower ratio of the number of nights to the number of trips - for all overnight trips - and ratio of the expenditure (£mil) to number of all overnight trips (thousands). Lower % of trips 1-3 and 8+ nights. Higher % of 4-7 night trips. By nights attributed: lower % of trips of length 1-3 nights, higher % of 4-7 and 8+ nights. Lower % of holidays length 1-3 and 4-7 nights. Higher % of holidays 8+ nights (also by nights attributed). Higher % of VFR trips of length 1-3 nights. Lower % of 4-7 and 8+ nights. By nights attributed: higher % of VFR trips 1-3 and 4-7 nights, lower % of VFR trips for 8+ nights. Lower % of business trips of length 1-3 and 8+ nights. Higher % of business trips of length 4-7 nights (also by nights attributed). RUC 3 - urban. | |

| 4 (Contains 42 locations including 33 London Boroughs) | Higher ratio of the number of nights to the number of trips - for all overnight trips. Higher ratio of the expenditure (£mil) to number of all overnight trips (thousands). Lower % of trips of length 1-3 and 8+ nights. Higher % of trips of length 4-7 nights. Lower % of nights attributed to trips of length 1-3 nights. Higher % of nights attributed to trips of length 4-7 and 8+ nights. Higher % of holidays and VFR trips of length 4-7 and 8+ nights. Lower % of holidays and VFR trips of length 1-3 nights (also by nights attributed). Higher % of business trips of length 4-7 and 8+ nights. Lower % of business trips of length 1-3 nights. By nights attributed, lower % of nights attributed to business trips of length 1-3 and 4-7 nights. Higher % of nights attributed to business trips of length 8+ nights. RUC 2 - rural. | |

| 5 (contains 21 locations) | Higher ratio of the number of nights to the number of trips - for all overnight trips. Lower ratio of the expenditure (£mil) to number of all overnight trips (thousands). Lower % of trips of length 1-3 and 8+ nights. Higher % of trips of length 4-7 nights. By nights attributed, lower % of trips of length 1-3 nights. Higher % of trips of length 4-7 and 8+ nights. Lower % of holidays and VFR trips of length 1-3 nights. Higher % of trips of length 4-7 and 8+ nights (also by nights attributed). Lower % of business trips of length 1-3 and 8+ nights. Higher % of 4-7 night trips (also by nights attributed). RUC 3 - urban. | |

| Missing | 7: East Riding of Yorkshire, Isles of Scilly, Knowsley, St Helens, Gateshead, Blaenau Gwent and Merthyr Tydfil | |

| Source: Office for National Statistics | ||

Download this table Table 9: Cluster information for Theme Three (including characteristics of each cluster and summary of geographical areas covered, number of members in each cluster)

.xls (35.8 kB)Theme 4: Inbound Tourism

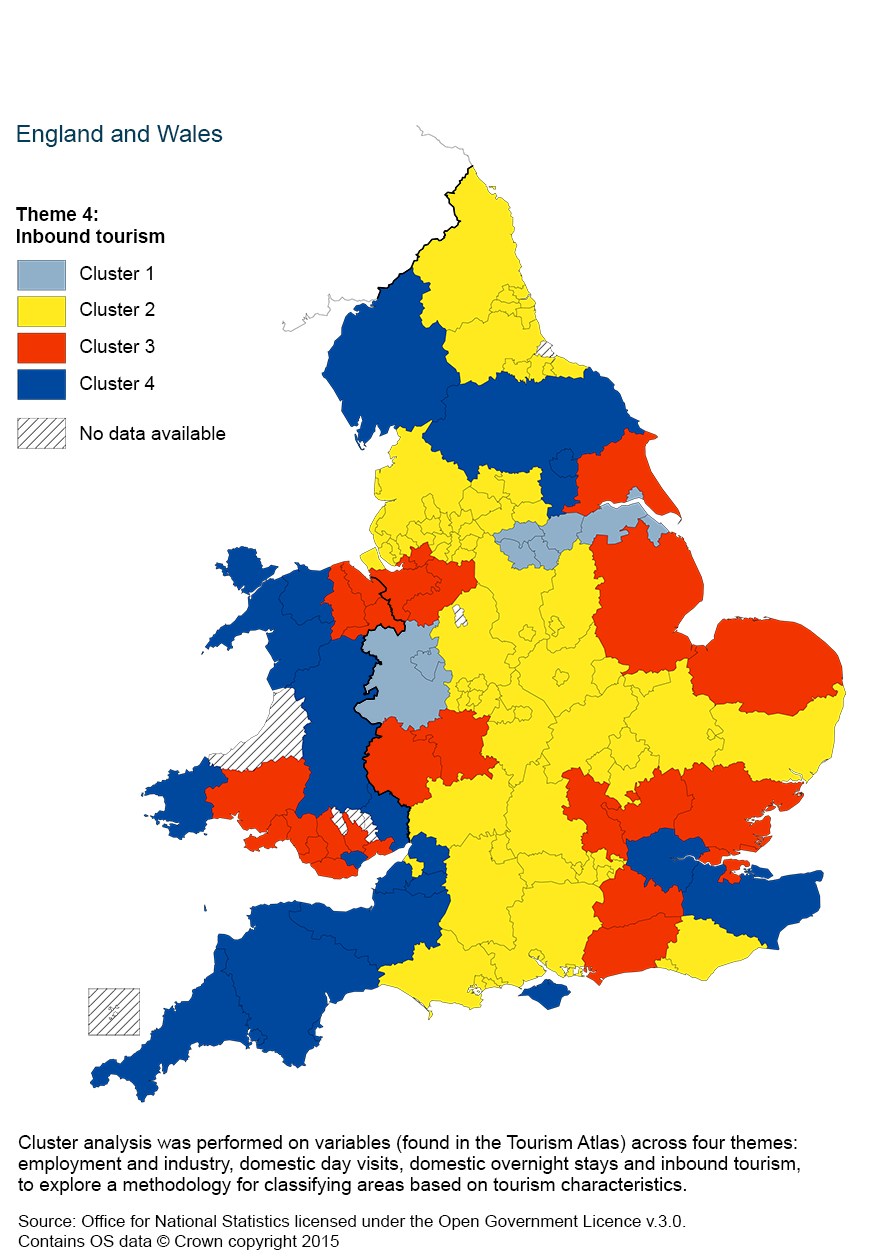

Inbound tourism constitutes trips by overseas visitors who come to England or Wales for one or more nights. Data from the International Passenger Survey that is included in the Atlas of Tourism is used in this theme (averaged data from 2011-2013).

Theme 4 contains 59 variables. Using the k-means cluster analysis, the geographical areas are grouped into four clusters.

The variables included in this theme are the breakdown of percentage of visitors and expenditure from the Americas (Am), Europe (Eu), Australasia (Au) and visitors from ‘Other’ countries (i.e. Asia and Africa), breakdown of visits by purpose (holiday, business, studying, visiting friends and relatives and other), percentage of nights stayed and expenditure by Am, Eu, Au and ‘Other’ visitors for each purpose listed above.

Map 5: Cluster analysis of inbound tourism, using a four cluster classification by county and unitary authority, 2011 to 2013

Download this image Map 5: Cluster analysis of inbound tourism, using a four cluster classification by county and unitary authority, 2011 to 2013

.png (324.9 kB)

Table 10: Cluster information for Theme Four (including characteristics of each cluster and summary of geographical areas covered, number of members in each cluster)

| Cluster number | Cluster characteristics | |

| 1 (contains 9 locations) | Lower % of nights stayed by Am, Eu and Au Inbound visitors. Higher % of nights stayed by visitors from ‘Other’ countries. Higher % of expenditure by Am and ‘Other’ visitors. Lower % of expenditure by Au and Eu visitors. Lower % of nights stayed on holiday and business by inbound tourists. Higher % of nights stayed on studying, VFR and ‘other’ by inbound tourists. Lower % of expenditure on holiday, business and VFR by inbound tourists. Higher % of expenditure on ‘other’ and studying by inbound tourists. Higher % of nights stayed by Am on holiday and studying. Lower % of nights stayed on business, VFR and ‘other’. Higher % of expenditure on studying, VFR and ‘other’. Lower % of expenditure on holiday and business. Higher % of nights stayed by Eu visitors on VFR and ‘other’. Lower % of nights stayed on holiday, business and studying. Higher % of expenditure by Eu visitors on VFR. Lower % of expenditure on holiday, business, studying and ‘other’. Higher % of nights stayed by Au visitors on VFR and ‘other’. Lower % of nights stayed on holiday, business and studying. Higher % of expenditure on business, VFR and ‘other’. Lower % of expenditure on holiday and studying. Higher % of nights stayed and expenditure by ‘Other’ visitors on studying and ‘other’. Lower % of nights stayed and expenditure on holiday, business and VFR. RUC 4 - urban. | |

| 2 (contains 76 locations) | Higher % of nights stayed by Au and ‘Other’ visitors. Lower % of nights stayed Am and Eu visitors. Higher % of expenditure by Eu, Au and ‘Other’ visitors. Lower % of expenditure by Am visitors. Higher % of nights stayed and expenditure on business, studying and VFR by inbound tourists. Lower % of nights stayed and expenditure on holiday and ‘other’ by inbound tourists. Higher % of nights stayed by Am visitors on business and VFR. Lower % of nights stayed on holiday, studying and ‘other’. Higher % of expenditure on business, studying and VFR. Lower % of expenditure on holiday and ‘other’. Lower % of nights stayed by Eu visitors on holiday. Higher % of nights stayed on business, studying, VFR and ‘other’. Lower % of expenditure on holiday and VFR. Higher % of expenditure on business, studying and ‘other’. Average % of nights stayed by Au visitors on ‘other’. Higher % of nights stayed on business and studying. Lower % of nights stayed on holiday and VFR. Higher % of expenditure by Au on business, studying and ‘other’. Lower % of expenditure on holiday and VFR. Higher % of nights stayed by ‘Other’ on business and studying. Lower % of nights stayed on holiday, VFR and ‘other’. Higher % of expenditure on business, studying and VFR. Lower % of expenditure on holiday and ‘other’. RUC 4 - urban. | |

| 3 (contains 29 locations) | Higher % of nights stayed by Am, Eu and Au visitors. Lower % of nights stayed by ‘Other’. Higher % of expenditure by Eu and Au. Lower % of expenditure by Am and ‘Other’. Higher % of nights stayed on VFR and ‘other’ by inbound tourists. Lower % of nights stayed on holiday, business and studying by inbound tourists. Higher % of expenditure on VFR by inbound tourists. Lower % of expenditure on holiday, business, studying and ‘other’ by inbound tourists. Higher % of nights stayed and expenditure by Am and Eu visitors on VFR and ‘other’. Lower % of nights stayed and expenditure on holidays, business and studying. Higher % of nights stayed by Au visitors on VFR. Lower % of nights stayed on holiday, business, studying and ‘other’. Average % of expenditure on holidays. Lower % of expenditure on business, studying and ‘other’. Higher % of expenditure on VFR. Higher % of nights stayed and expenditure by ‘Other’ visitors on business and VFR. Lower % of nights stayed and expenditure on holiday, studying and ‘other’. RUC 3 - urban. | |

| 4 (contains 53 locations, including 33 London boroughs) | Higher % of nights stayed by Am and Eu visitors. Lower % of nights stayed by Au and ‘Other’. Higher % of expenditure by Am visitors. Lower % of expenditure by Eu, Au and ‘Other’ visitors. Higher % of nights stayed and expenditure on holidays by inbound tourists. Lower % of nights stayed and expenditure on business, studying, VFR and ‘other’ by inbound tourists. Higher % of nights stayed by Am on holiday, business and studying. Lower % of nights stayed on VFR and other. Higher % of expenditure on holiday. Lower % of expenditure on business, studying, VFR and ‘other’. Higher % of nights stayed and expenditure by Eu and ‘Other’ visitors on holiday. Lower % of nights stayed and expenditure on business, studying, VFR and ‘other’. Higher % of nights stayed and expenditure by Au on holiday and business. Lower % of nights stayed and expenditure on studying, VFR and ‘other’. RUC 5 - urban. | |

| Missing | 7: Hartlepool, Stoke-on-Trent, Isles of Scilly, Ceredigion, Blaenau Gwent, Torfaen, Merthyr Tydfil | |

| Source: Office for National Statistics | ||

Download this table Table 10: Cluster information for Theme Four (including characteristics of each cluster and summary of geographical areas covered, number of members in each cluster)

.xls (41.0 kB)6. Factor Analysis to reduce the number of variables

In order to construct an overall cluster analysis of all of the tourism variables included in the Atlas of Tourism, it was first necessary to try and reduce the number of variables that were fed into the final analysis. This section describes the methodology for achieving this.

From the themes included in the Atlas of Tourism, there are a total of 172 observations per location. Due to the large number of variables and as many of the variables are inter-related, the analysis of the results was highly complex. A factor analysis was, therefore, performed on all variables across the themes with the aim of reducing the number of variables, and then grouping these variables into four factors with the aim of reducing the complexity of the analysis.

In order to assess to relationship between a location and a factor (i.e. whether characteristics of that factor are present in the location), a factor score measure was introduced. An individual factor score was calculated for each county and unitary authority, for each of the four factors. The higher (or more positive) the factor score, the stronger the relationship between the area and characteristics held by the factor. A negative factor score means that the location doesn’t share many (if any) characteristics associated with the factor. For further information on how the factor score was calculated, please refer to the methodology section.

Factor one contains the following characteristics (categorised by theme):

Employment and industry:

lower % of jobs in food and beverage serving activities

higher % of workers age 25 to 64 are working in the tourism industry (rather than in the economy)

lower % of tourism workers are aged 16 to 24

higher % of tourism workers are aged 30 to 39

higher % of workers have degree or higher education level or equivalent qualifications

lower % of workers have GCE or GCSE level or equivalent qualifications

higher % of main tourism jobs in economy

higher % of tourism enterprises

Domestic day visits:

higher % of expenditure on day visits of length 3 to 3.59 hours

lower % of expenditure on day visits of length 5 to 5.59 hours

Domestic overnight trips:

higher ratio of expenditure (£mil) to number of all overnight trips (thousands)

higher % of trips of 8+ nights

Inbound trips:

lower % of expenditure on inbound visits by Au people

higher % of nights stayed and expenditure on holidays by inbound tourists

lower % of nights stayed and expenditure on VFR visits by inbound tourists

higher % of nights stayed and expenditure on holidays by Am, Eu, Au and 'Other' visitors

lower % of nights stayed and expenditure on VFR by Am and Eu visitors

lower % of expenditure on VFR by Au and 'Other' visitors

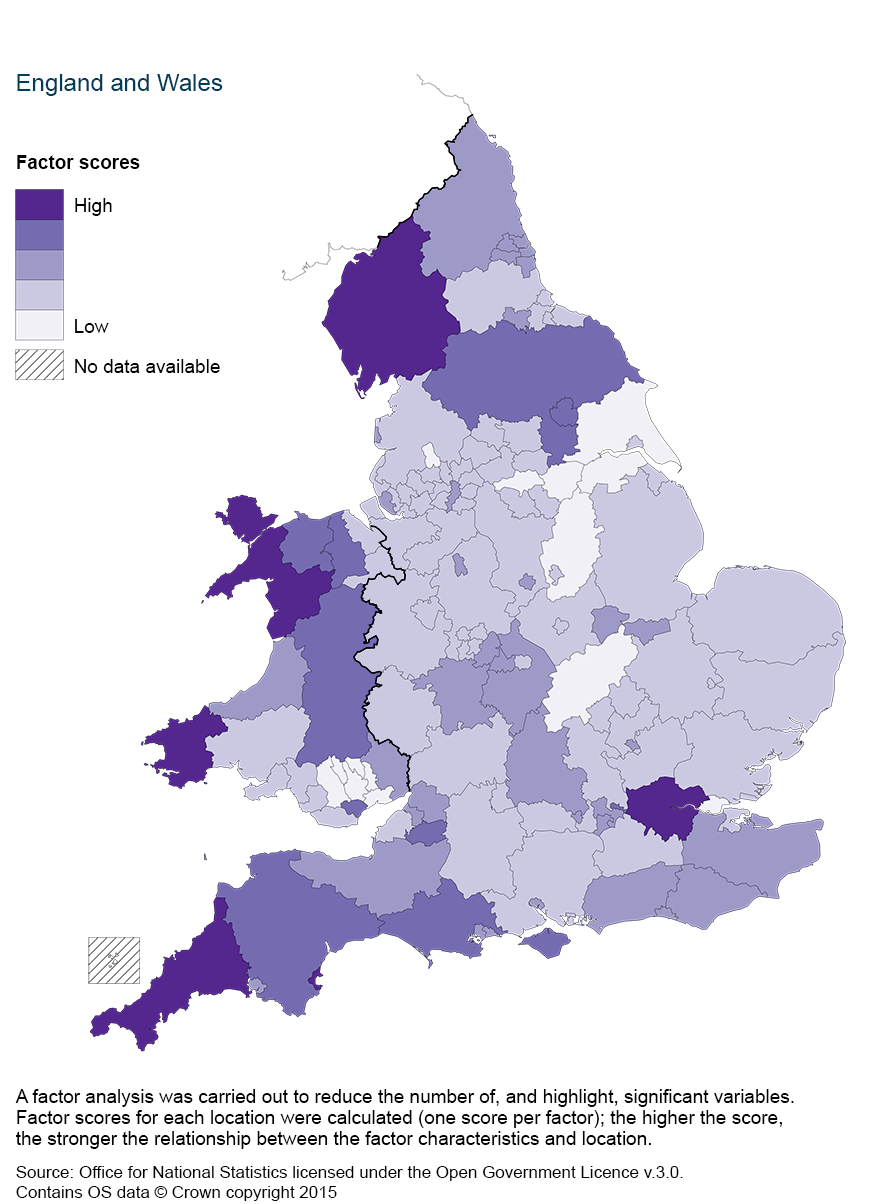

Map 6: Factor Scores of factor one, by county and unitary authority, 2011 to 2013

Download this image Map 6: Factor Scores of factor one, by county and unitary authority, 2011 to 2013

.png (325.3 kB)This map shows that Pembrokeshire, Isle of Anglesey, Gwynedd, Cornwall, Torbay, Cumbria and Greater London, for example, all strongly share the characteristics displayed in factor one, whereas locations such as Northamptonshire and the Welsh Valleys (amongst other areas) do not share the characteristics of factor one.

Factor two contains the following characteristics (categorised by theme):

Employment and industry:

higher % of jobs in accommodation for visitors

lower % of jobs in passenger transport, travel agencies, vehicle hire etc.

higher % of 16 to 19 workers in the tourism industry

higher % of 16 to 19 year olds working in tourism as main job

lower % of 25 to 34 year olds working in tourism as main job

higher % of 60+ working in tourism as main job

higher % of main jobs in tourism

lower RUC (more rural)

Domestic day visits:

- higher % of day visits for outdoor leisure activities and exploring an area

Domestic overnight trips:

higher number of nights to the number of trips - for all overnight trips - ratio

lower % of trips 1 to 3 nights (also by nights attributed)

higher % of trips 4 to 7 nights (also by nights attributed)

lower % of holiday, business (both by nights attributed), and VFR trips 1-3 nights

higher % of holiday and VFR trips length 4-7 nights (also by nights attributed) and business trips 4-7

Inbound trips:

higher % of nights stayed and expenditure by Eu inbound visitors

lower % of nights stayed and expenditure by inbound visitors from 'Other' countries

lower % of nights stayed and expenditure on business trips by inbound tourists

lower % of nights stayed and expenditure on visits for a business purpose by Am, Eu and Au inbound visitors

lower % of expenditure on visits for a business purpose by inbound visitors from 'Other' countries

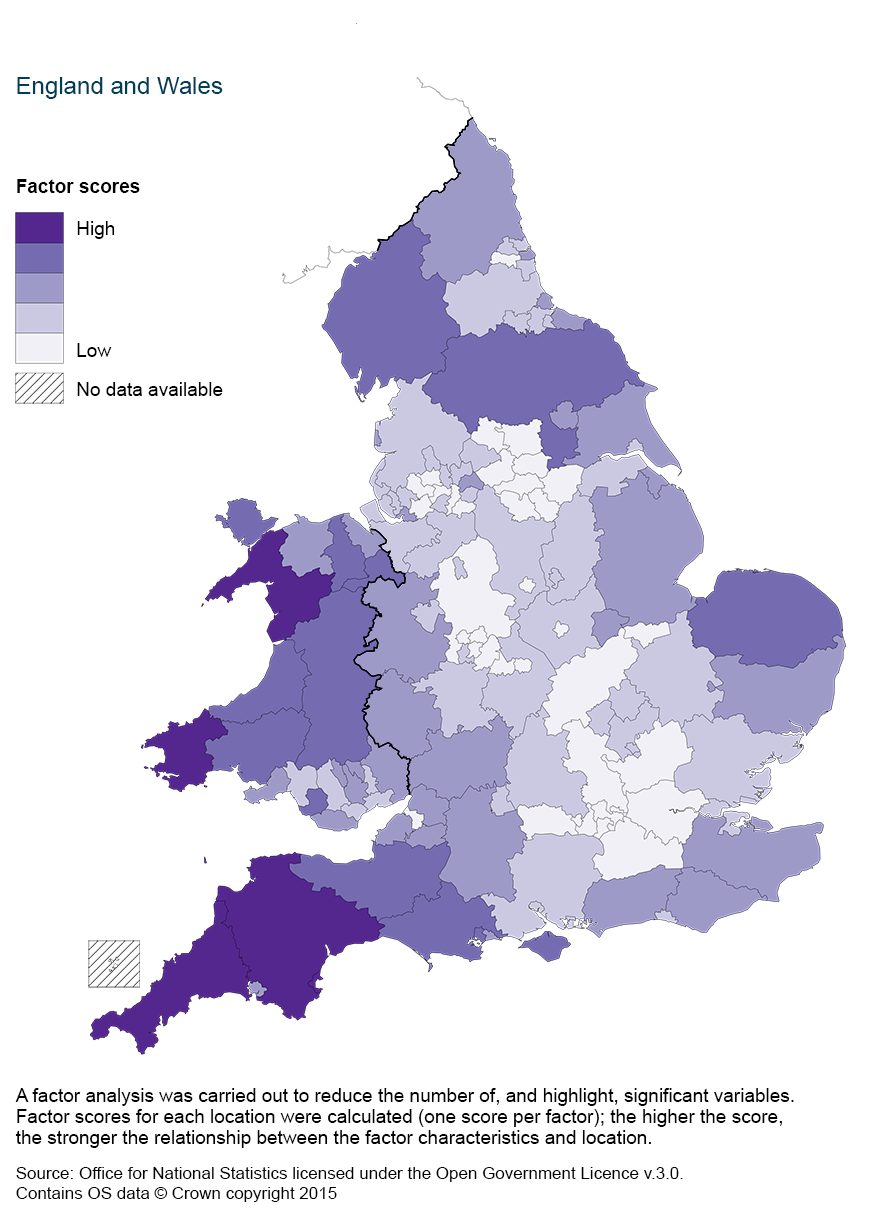

Map 7: Factor score of factor two by county and unitary authority, 2011 to 2013

Download this image Map 7: Factor score of factor two by county and unitary authority, 2011 to 2013

.png (326.0 kB)This map shows that Pembrokeshire, Gwynedd, Cornwall, Torbay and Devon, for example, strongly share the characteristics of factor two whereas locations such as Greater London, Northamptonshire, and parts of the Midlands and North do not share these characteristics at all.

Factor three contains the following characteristics from theme 4 (inbound tourism):

lower % of nights stayed by Am visitors

higher % of nights stayed and expenditure by inbound visitors from 'Other' countries

higher % of nights stayed and expenditure on studying by inbound tourists

lower % of nights stayed on VFR visits by inbound tourists

higher % of expenditure on studying by Am visitors

higher % of nights stayed on studying by Eu, Au and 'Other' visitors

higher % of expenditure on studying by Eu, Au and 'Other' visitors

lower % of nights stayed for VFR visits by Au visitors

lower % of nights stayed and expenditure for holidays by Au visitors

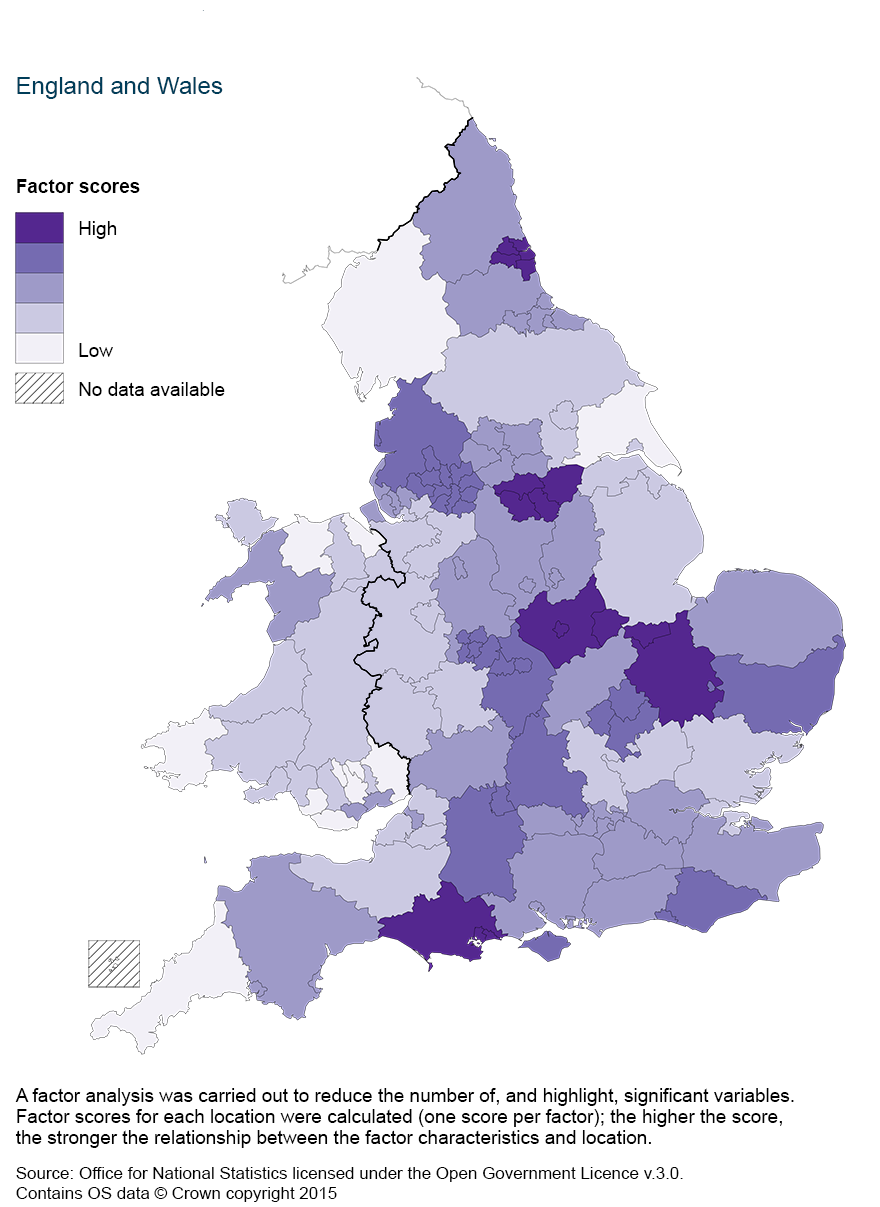

Map 8: Factor scores of factor three, by county and unitary authority, 2011 to 2013

Download this image Map 8: Factor scores of factor three, by county and unitary authority, 2011 to 2013

.png (328.8 kB)This map shows that Dorset, Cambridgeshire, Peterborough, Doncaster, Rotherham and Sheffield, for example, all strongly share the characteristics of factor three, whereas locations such as Pembrokeshire, Cumbria, Cornwall and East Riding of Yorkshire do not share the characteristics of factor three.

Factor four contains the following characteristics from theme 4 (inbound tourism):

lower % of nights stayed for business by inbound tourists

higher % of nights stayed and expenditure for 'other' purposes

higher % of nights stayed for 'other' purposes by Eu Inbound visitors

lower % of expenditure for business purposes from visitors from 'Other' countries

higher % of nights stayed and expenditure by 'Other' visitors on 'other' purposes

(329 Kb)

This map shows that areas on the England-Wales border, Devon, Plymouth, Wiltshire, Swindon and some part of North England strongly share the characteristics of factor four, whereas locations including some areas of the Midlands and South, such as Southampton and Staffordshire, do not share characteristics of factor four.

These variables contained in these four factors were then used to produce the final cluster analysis of locations highlighted in section two of this report.

Back to table of contents