Table of contents

1. Introduction

This article provides the first set of experimental statistics on the financial assets and liabilities of the UK insurance sector, based on data collected under Solvency II (SII). From 2016, SII has replaced its predecessor, Solvency I (SI) as the Europe-wide insurance regulatory framework.

Unlike SI, SII provides quarterly as well as annual information and covers a wider range of variables than SI. Office for National Statistics (ONS) has recently concluded that quarterly and annual SII data are suitable for national accounts compilation, including financial accounts aggregates, giving the potential to replace some of our existing insurance surveys.

Enhanced financial accounts development programme

SII has the potential to improve the quality of economic statistics for the insurance corporations sector and the use of SII data is an important element of the Enhanced financial accounts (EFA) programme1.

The EFA programme was set up by ONS and the Bank of England in 2016 in recognition of the demand for improved financial statistics following the last financial crisis. For example, the Independent Review of UK Economic Statistics2 identified more detailed and complete financial statistics as an area for development. The International Monetary Fund’s (IMF) G20 Data Gaps Initiative Phase 2 (DGI) embodies a set of 20 recommendations for the improvement of economic and financial statistics internationally.

EFA objectives reflect these demands and include development of flow of funds (whom-to-whom)1 financial statistics. Where possible, the preferred approach is to use administrative or regulatory data, rather than surveys, to deliver the EFA improvements. As a regulatory source, SII fits in with this and using it will help to reduce the respondent burden from surveys.

The release of experimental statistics at the earliest opportunity is another aim under the EFA programme. This gives users early sight of developments and opportunity to give feedback. As the first set of experimental statistics linked to EFA, the SII-based statistics for insurance are an important marker of progress.

Release of a full set of experimental flow of funds statistics for all sectors of the UK economy (including insurance) is planned for 2019.

The earliest that full implementation of SII in the UK National Accounts is likely to be feasible is 2020. Full implementation will include flow of funds estimates for the insurance corporations sector that are completely consistent with the official national accounts. It will also include a review of the pre-2016 estimates for insurance in the light of the SII data for 2016 and after. This may lead to revisions to historical national accounts estimates for insurance and the wider financial accounts.

The remainder of the article is structured as follows:

overview of insurance and the UK insurance market

overview of the SII framework and how it is used in compiling financial accounts data

presentation of experimental SII-based financial statistics

conclusions and next steps

Notes for Introduction:

- Mathews D, Nolan L. (2016)

- Bean C. (2016)

2. Understanding insurance and the UK insurance market

This section defines insurance as an economic activity and describes the different types of insurance and the characteristics of the UK insurance market.

Understanding insurance

Definition of insurance

Insurance is a contract (policy) between the insurer (services provider) and an individual or entity (policyholder), which compensates the policyholder (or designated individual) for specified risks of financial loss, damage, illness or death. In return for such compensation (claims), policyholders pay premiums to the insurer.

By pooling policyholders’ risks, the insurer may generate income by receiving more in premiums than it pays out in claims. Furthermore, the insurer may invest the collected funds from premiums in financial and non-financial assets to meet future claims.

Insurance can be subdivided in two ways: direct insurance versus reinsurance, and life versus non-life insurance.

Direct insurance versus reinsurance

The most common type of insurance is direct insurance, where private individuals or non-insurance businesses insure themselves with an insurer against specific risks. In turn, direct insurers may insure themselves by insuring part of the directly-insured risks with other insurers. This is reinsurance. Furthermore, a reinsurer may insure itself to spread the risk further with other reinsurers. This extension of the reinsurance is known as retrocession.

Life versus non-life insurance

In life insurance, a policyholder makes regular payments to an insurer in return for which the insurer pays the beneficiary an agreed sum, or an annuity at a given date, or earlier if the insured person dies beforehand. In economic terms, a life policy can grant benefits arising from a series of risks.

It should be noted that nowadays much of life insurance business is in fact the provision of pensions and pension fund management services (see Section 3).

Life insurance can often take the form of a savings product and under national accounts definitions1 it includes products that would generally be regarded as pensions:

the majority of individual pensions are treated as life insurance

pension schemes provided on a collective basis via the workplace, or where an employer makes a contribution, are classed as pensions in the national accounts even when they are provided by life insurers

Many authorised life insurers provide both life insurance and pensions policies, and some provide pension policies only. The pension products are referred to as “insurer-provided pensions”.

In some cases, the principal activity of authorised insurers is in pension fund management, rather than provision of insurance products. These are treated as special cases.

In non-life insurance, a policyholder makes regular payments to an insurer to provide the beneficiary with an agreed sum on the occurrence of an event other than the death of the insured person. Examples include buildings, marine, aviation and motor insurance as well as cover for individuals against risks such as sickness or loss of income.

UK insurer population

There are around 400 active authorised insurers incorporated in the UK, including approximately 110 Lloyds of London syndicates. Most authorised insurers specialise in either life or non-life insurance and may carry out direct insurance or reinsurance or a combination. There are some insurers who provide both life insurance and non-life insurance. These are known as composite insurers.

Lloyds syndicates are temporary entities that specialise in insuring businesses and individuals against risks not covered by standard policies. The great majority of their activity is classed as non-life. Lloyds of London is a world leader in providing a marketplace for this sector.

Notes for Understanding insurance and the UK insurance market:

- UK National Accounts comply with the European System of Accounts 2010 (ESA 2010).

3. Conceptual framework

Solvency II framework: overview

Reporting under Solvency II (SII) is harmonised at European level by the European Insurance and Occupational Pensions Authority (EIOPA). This ensures comparability at the European level.

In the UK, SII implementation and data collection are carried out by the Bank of England through the Prudential Regulation Authority (PRA)1. A small number of Office for National Statistics (ONS) staff were seconded to the Bank of England and were provided with access to company-level SII data for statistical compilation purposes.

Solvency II coverage

SII covers around 97% of UK insurers’ economic activity; unlike Solvency I (SI), it includes Lloyds of London syndicates. Out of the total population of around 400, about 180 smaller companies are eligible for a waiver and do not return data for all periods or only return certain templates. However, most business is done by large companies, so the impact of the waivers on financial aggregates is small.

Given SII’s high level of coverage, we have not attempted to estimate values for the uncollected units in the experimental statistics presented in this article. Estimation for uncollected units is more difficult for regulatory sources such as SII than for surveys based on a statistically-drawn sample. We plan to review the treatment of insurers not captured by SII as part of the work towards full national accounts implementation.

Solvency II templates

SII data are collected via templates, each one providing a branch of the company’s regulatory reporting, for example, profit and loss accounts and balance sheet (including technical reserves). Templates cover almost all of the building blocks needed for the insurance components of the national accounts. SII templates come in two main forms:

closed templates record higher-level variables, such as premiums and claims, and balance sheet totals, where a single value for each variable is reported in each period

open templates capture detailed information such as asset holdings or investments by type and counterparty exposure, where they itemise holdings under each category

Most templates collect quarterly and annual data but in some cases quarterly data is less detailed.

Life and non-life insurance are separately identified but there are differences between SII and national accounts definitions (European System of Accounts: ESA 2010). Corrections for these differences are explained in Section 4. The templates also collect separate data for direct insurance and reinsurance.

Publication of Solvency II returns

Insurers are required to publish their annual SII returns under many of the closed tables. All aggregates based on quarterly or unpublished annual returns are checked for disclosure of individual companies. ONS will not release any aggregates that are disclosive of unpublished company-level data without express permission.

Current ONS publication of financial data for the insurance corporations sector

UK National Accounts

The insurance corporations sector is not currently identified separately in the national accounts. Instead, the insurance corporations and pension funds sectors are presented as a combined sector. Data for the combined sector are published in ONS’s quarterly UK Economic Accounts and annual UK National Accounts, The Blue Book publications. Financial data cover both balance sheet levels and transactions.

As noted in the introduction, the plan is to use SII as the main insurance source for the national accounts. Separate identification of the insurance corporations and pension funds sectors will be one of the improvements linked to SII implementation.

Compilation of the experimental statistics for the insurance corporations sector differs from the existing national accounts in that, in the experimental statistics, assets and liabilities are shown on a non-consolidated, gross of reinsurance basis, that is, assets and liabilities linked to reinsurance add to the totals. In the current national accounts, insurers’ assets and liabilities are compiled on a net of reinsurance basis. This netting out means that reinsurers’ assets and liabilities do not add to the totals. Instead, they are subsumed into the balance sheets of the direct insurers that cede the reinsurance business to them. The treatment in the experimental statistics is an improvement as it is the preferred approach under ESA 2010.

In other respects, compilation methods in the experimental statistics and in the current national accounts are consistent, for example, authorised insurers acting mainly as pension fund managers are excluded from the population of insurers in both cases. More details of the treatment of fund managers are given later in this section.

MQ5

Financial data for the insurance corporations sector are included in ONS’s quarterly publication, MQ5: investment by insurance companies, pension funds and trusts. Data include balance sheet levels and transactions. Estimates in MQ5 are based on ONS quarterly and annual surveys of financial institutions. These surveys also feed into the financial accounts but there are differences in compilation methods and in presentation:

in MQ5, the insurance corporations sector is separately identified and split into life and non-life

estimates in MQ5 exclude Lloyds of London syndicates

insurers that act as pension fund managers are kept in the MQ5 insurance population2

As in the national accounts, insurers’ assets and liabilities are shown on a net of reinsurance basis in MQ5.

Supplementary table on pensions

The Supplementary table on pension schemes in social insurance3 shows the total UK liabilities in government and workplace pensions (including those provided by insurers). It is produced in line with ESA 2010 guidelines and is designed to complement the national accounts. The Supplementary table itself includes estimates of the workplace pensions and annuities provided by insurers. To accompany the table, ONS also provides estimates of insurers’ liabilities in individual pensions. The latest publication was on 7 March 2018 and shows annual data from 2010 to 2015.

Current sources for insurance components include SI and MQ5. It is planned to use SII as a source for future publications.

As in the core national accounts and the experimental SII statistics, estimates for insurers in the Supplementary table exclude entities whose main function is pension fund management.

Special case: treatment of fund managers

Current approach

A number of UK insurers are authorised to provide (underwrite) life insurance policies but instead, they are engaged mainly in asset management of pension funds. In some cases, the managed funds will be recorded by both the fund-managing insurers and the client pension providers. This would result in double-counting of the relevant assets and liabilities. These pension fund manager entities have a large impact as over 30% of overall life insurers’ technical reserves relate to managing pension funds. Technical reserves are discussed further in Section 4 of this article.

In the current UK National Accounts, approximately 10 companies are identified as fund managers and their data removed from the published aggregates. This is referred to as the adjustment for “insurance-managed pension funds” and is to avoid double-counting.

Proposals for Solvency II

We plan to make incremental improvements to the treatment of pension fund managers as part of the implementation of SII.

We have identified two types of fund manager entities:

those whose business is solely managing funds on behalf of pension schemes

those who manage funds but also sell their own insurance products

For the experimental statistics, we have removed 11 companies from the SII population. Most of these fall into the solely managing funds on behalf of pension schemes category.

Developing a more definitive treatment of those who manage funds but also sell their own insurance products is a substantial piece of work. We have identified this as a priority for future development. Planned future development also includes an assessment of whether any pension fund managers in the SII population should be classified as financial auxiliaries. In some cases, this may be the correct treatment under ESA 2010.

Notes for Conceptual framework:

The Bank of England prudentially regulates and supervises financial services firms through the Prudential Regulation Authority (PRA). Prudential regulation rules require insurance and other financial firms to hold sufficient capital and have adequate risk controls in place. Close supervision of firms ensures that they have a comprehensive overview of their activities so that they can step in if they are not being run in a safe and sound way or, in the case of insurers, if they are not protecting policyholders adequately.

It should be noted that pension fund managers are covered by both MQ5 surveys on insurance and pension funds subsector. However, the aggregated National Accounts data sourced from the MQ5 will include an adjustment to remove double-counting of the pension fund managers.

The supplementary table on pensions, referred to as table 29 in the Eurostat transmission programme, presents all accrued-to-date pension entitlements in social insurance.

4. Compiling financial accounts statistics for life and non-life insurance

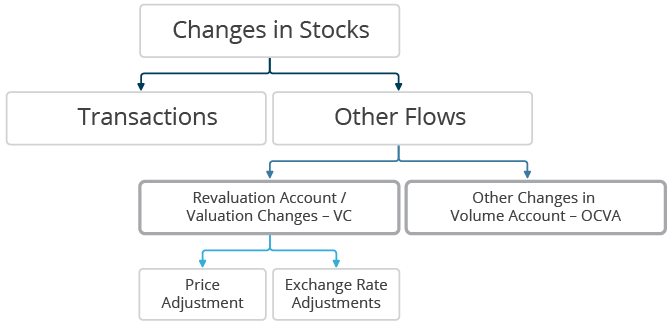

The structure of the financial accounts is illustrated in Figure 1 and it consists of:

financial balance sheets: these represent the value of the outstanding stocks of a category of financial assets or liabilities at the end of a given accounting period

financial transactions: these represent financial flows that arise, by mutual agreement between institutional units, from the creation, liquidation, or change in ownership of financial assets or liabilities; changes in ownership occur through the sale, transfer, or other discharge of all rights, obligations and risks associated with a financial asset or liability

other flows, which are further broken down into valuation changes (recorded in the revaluation account) and other changes in volume (recorded in the other changes in volume account)

Valuation changes (revaluation account)

These represent financial flows arising from changes in the prices of financial assets and liabilities, and/or the exchange rates that affect the pounds sterling values of assets and liabilities denominated in foreign currency.

Other changes in volume account (OCVA)

This represents financial flows that arise from asset and liability changes other than those arising from transactions and revaluations. They consist mainly of write-offs of claims and reclassification of assets.

Figure 1: Structure of the financial accounts according to European System of Accounts 2010

Source: European System of Accounts 2010

Download this image Figure 1: Structure of the financial accounts according to European System of Accounts 2010

.png (17.3 kB)The relationship between the different parts of the financial accounts is given by the following accounting identity:

Stock t – Stock t-1 – Transaction t – VC t – OVCA t = 0

In line with the operating model for the insurance corporations sector, the financial accounts can be split into three main components.

Technical reserves liabilities

Technical reserves are the reserves that insurers hold to meet their obligations. They are insurers’ largest liabilities and totalled just under £1.5 trillion for UK insurers in 2016. They give rise to matching assets for policyholders. Technical reserves are sub-divided into:

non-life technical reserves

life insurance and annuity entitlements

pension entitlements

Within these, life and pensions technical reserves are much bigger than those for non-life. Life insurance and annuity entitlements correspond to financial claims that life insurance policyholders and beneficiaries of annuities have against insurers providing life insurance. Pensions entitlements correspond to financial claims that future pensioners (current employees) and current pensioners (former employees) have against insurers providing pensions. For non-life insurance, technical reserves correspond to non-life insurance policyholders’ premiums paid for periods that have not yet elapsed and claims incurred but not yet paid.

Technical reserves from reinsurance are classified according to the classification of the original policy.

Assets

These are investments financed largely from technical reserves in different types of financial assets and some non-financial assets such as buildings.

Liabilities other than technical reserves

These include: deposits from reinsurers, debts owed to credit institutions, subordinated liabilities and derivatives liabilities.

Mapping Solvency II definitions to national accounts classifications

To compile financial accounts statistics for the insurance corporations sector, detailed bridge tables were developed to map data reported in the Solvency II (SII) framework into European System of Accounts: ESA 2010 standards. A summary of the bridge tables is provided in this section.

Technical reserves liabilities

The experimental statistics presented in Section 5 include separate estimates for non-life technical reserves. For life insurance, reserves for life insurance and annuity entitlements and pension entitlements are shown as combined totals.

The SII non-life definition is broadly consistent with ESA 2010. The main exception is that, under SII, some types of health insurance are grouped with life. Under ESA 2010, all health insurance should be classed as non-life and the relevant technical reserves have been included with non-life in the experimental statistics sourced from the quarterly balance sheet closed template.

The SII life insurance category includes both life insurance and pensions products as defined by ESA 2010. Currently, SII does not give the information needed to separate technical reserves between life insurance and pensions reliably. That is why they are merged in the experimental statistics. This is set to improve. Office for National Statistics (ONS) and the Prudential Regulation Authority (PRA) have agreed changes to SII classifications that are now being implemented. They will make future apportioning of life insurers’ technical reserves between life insurance and pensions products much more straightforward and robust.

Assets

The most important asset types, including debt securities, shares, equities and investment funds are collected in detail in a quarterly open template in which insurers give item-by-item details of all their holdings of the relevant asset types (according to Complementary Identification Code – CIC)1 and by currency. Furthermore, for every single security holding, counterpart information is provided including issuer’s country and industrial allocation2. ONS has developed a mapping between CIC and ESA 2010 financial instrument codes as well as a mapping of issuers’ industrial classification into ESA 2010 institutional sectors.

However, derivative assets and technical reserves assets (also known as reinsurance recoverables) were compiled from the quarterly balance sheet closed template. The technical reserves assets are held by ceding insurers and reinsurers. Technical reserves assets shown in the experimental statistics are estimated in the same way as the technical reserves liabilities.

Liabilities other than technical reserves

Most insurers’ liabilities other than technical reserves can be allocated into ESA 2010 instrument classifications from the quarterly balance sheet closed template. The exception is equity liabilities, which are estimated from the SII template for insurers’ own funds.

Compiling transactions, revaluation and other changes in volume within financial accounts

The SII experimental financial statistics include estimates of transactions for selected instruments. This section explains the methods used for these estimates.

Other changes in volume: general approach

Other changes in volume (OCV) include level shifts due to reclassifications or write-offs. For the euro area, the European Central Bank (ECB) specified additions to the SII templates to include these variables. However, UK insurers are not required to provide information about OCV in their SII returns. For this reason, we assume that OCV are zero, unless specific information to the contrary is available.

Revaluations and transactions for non-negotiable instruments

Non-negotiable financial instruments consist of currency, loans and deposits. Asset holdings of these instruments are identified in SII, along with the issuing country and currency. Under ESA 2010, stocks of non-negotiable instruments should be valued at nominal prices. For sterling non-negotiable instruments, there is no revaluation account. If OCV are zero, transactions are given by changes in stock at nominal prices as recorded in SII.

For non-sterling non-negotiable instruments, revaluations are given by applying exchange rates3 to the foreign currency stock levels. If OCV are zero, transactions equate to the residual after deducting revaluations from the converted changes in nominal levels.

Revaluations and transactions for negotiable instruments

Negotiable instruments include debt securities, and equities and investment fund shares. Debt securities include instruments such as corporate bonds, government securities and commercial paper. Equities and investment fund shares include listed and unlisted shares, and money market and non-money market investment funds.

Insurers’ asset holdings of these instruments are identifiable separately from the details in the open template for asset holdings. This open template also gives the information needed to calculate revaluations and transactions as summarised in the next section.

Debt securities

Interest is accrued on debt securities and, under ESA 2010, this should be recorded as a transaction (that is, the acquisition of more debt security by the holder). The open template includes accrued interest (I) and stocks levels reported at both market value (SII Value) and at clean price level (Par Amount), which excludes accrued interest. Market values are also reported as a percentage of the Par Amount (%P) for each debt instrument.

Thus, transactions equate to changes in Par Value (Par Amount) multiplied by average unit percentage price (%P) plus changes in accrued interest. Assuming zero OCV, revaluations are derived as a residual.

For non-sterling holdings, an additional exchange rate revaluation is calculated in the same way as for non-negotiable instruments.

Equity and investment fund shares

Transactions in equity and investment fund shares relate solely to acquisitions and disposals. The SII assets open template includes information on unit prices (P) and quantities (Q) that corresponds to stock at market value (SII Value) for individual equity holdings, thus SII Value equals P multiplied by Q.

Thus, transactions equate to changes in quantities (Q) multiplied by the corresponding average price (P). Assuming zero OCV, revaluations are derived as a residual, but reflect changes in prices (P).

Notes for Compiling financial accounts statistics for life and non-life insurance:

- CIC is the standard asset classification schema for insurance supervision.

- NACE rev. 2 is the European standard (industrial) classification of productive economic activities.

- Bank of England spot exchange rate

5. Solvency II: experimental financial statistics for the UK insurance corporations sector

This section shows experimental Solvency II (SII)-based financial statistics for the UK insurance corporations sector for Quarter 1 (Jan to Mar) 2016 to Quarter 4 (Oct to Dec) 2017. As experimental statistics, they are still under development. They are published to inform and involve users in the development process. It is worthwhile noting that the presentation of the data shows a level of detail that would meet the expectation of the enhanced financial accounts (UK flow of funds). However, the level of detail will increase in the future in preparation for incorporation into the national accounts.

Tables 1a and 1b show non-consolidated, non-seasonally adjusted quarterly asset and liability stocks, with selected transactions. Figures 2 and 3 show the proportions of UK insurers’ assets and liabilities by type as at Quarter 4 2016. As explained in Section 3, estimates are based on SII totals as received. We have not attempted to estimate values for insurers not captured by SII.

Tables 1a and 1b show that the overall paths of total assets and liabilities increased from Quarter 1 2016 to Quarter 3 (July to Sept) 2016, followed by a fall-back, after which levels were broadly stable, averaging just over £1.8 trillion.

Stocks of assets

Table 1a (Quarter 4 2016) and Figure 2 illustrate that the most important types of assets were:

debt securities (30%, £0.5 trillion), of which the majority were non-government issued

investment fund shares and units (28%, £0.5 trillion)

technical reserve assets (reinsurance recoverables) (15%, £0.3 trillion)

listed and unlisted shares and equity (12%, £0.2 trillion)

There were increases between Quarter 1 2016 and Quarter 3 2016 in all these asset types.

Between Quarter 1 2016 and Quarter 4 2017 (Tables 1a and 1b), there was a steady increase in the proportion of non-UK issued listed and unlisted share and equity assets (from 46% to 54% of total listed and unlisted share and equity assets) with a corresponding fall in holdings of UK-issued listed and unlisted share and equity assets.

Over the same period, the proportion of non-UK issued debt security assets increased slightly (from 43% to 45% of total debt securities) with a corresponding fall in UK-issued debt security.

As already explained, the experimental statistics show assets and liabilities on a gross of reinsurance basis – the preferred approach under European System of Accounts: ESA 2010. This means that insurers’ technical reserves assets (reinsurance recoverables) can be identified and Tables 1a and 1b confirm that they were sizable in all quarters between Quarter 1 2016 and Quarter 4 2017. The majority of these assets related to reinsurance of life and pensions policies.

This new information is a good example of the benefits that the added level of detail from SII will bring. Existing data sources dictate that these reinsurance-related assets are netted out in the current national accounts.

Stocks of liabilities

Table 1a and Figure 3 illustrate that the largest component of liabilities was technical reserves, which accounted for 81% of total liabilities in Quarter 4 2016. This percentage is also calculated on the preferred gross of reinsurance basis. On the net basis used in the current national accounts, it would be smaller.

Within total technical reserves liabilities, the largest sub-category was the technical reserves for unit and index-linked life insurance and pensions products.

Transactions in assets

Amongst the selected transactions in assets, there were net acquisitions between Quarter 1 2016 and Quarter 4 2017 in investment fund shares (£78 billion) and in loans (£48 billion). There were net disposals in listed shares (£15 billion) and in currency and deposits (£6 billion).

Table 1a: Assets and liabilities of the UK insurance corporations sector, UK, Quarter 1 (Jan to Mar) 2016 to Quarter 4 (Oct to Dec) 2016

| £ billion | ||||

| 2016 | ||||

|---|---|---|---|---|

| Q1 | Q2 | Q3 | Q4 | |

| STOCKS (ASSETS) | 1663 | 1776 | 1935 | 1843 |

| Currency and Deposits | 35 | 40 | 40 | 29 |

| Long-Term Government Securities | 180 | 200 | 205 | 197 |

| _Issued by UK Government | 134 | 146 | 149 | 145 |

| _Issued by non-residents | 46 | 54 | 57 | 52 |

| Other Debt securities | 341 | 347 | 361 | 348 |

| _Issued by UK residents | 164 | 163 | 170 | 161 |

| _Issued by non-residents | 177 | 184 | 191 | 187 |

| Loans | 84 | 83 | 121 | 129 |

| _To UK residents | 70 | 73 | 111 | 115 |

| _To non-residents | 14 | 10 | 11 | 14 |

| Listed Shares | 168 | 181 | 190 | 196 |

| _Issued by UK residents | 83 | 87 | 91 | 91 |

| _Issued by non-residents | 85 | 94 | 99 | 104 |

| Unlisted shares and Equities | 33 | 34 | 33 | 33 |

| _Issued by UK residents | 26 | 27 | 26 | 24 |

| _Issued by non-residents | 7 | 6 | 7 | 9 |

| Money Market Investment Fund shares | 54 | 62 | 64 | 69 |

| Non-Money Market Investment Fund Shares | 387 | 404 | 442 | 448 |

| Technical Reserves a | 223 | 250 | 299 | 269 |

| _Non-life | 36 | 41 | 43 | 44 |

| _Life & Pension | 188 | 209 | 256 | 224 |

| __Unit & Index Linked | 75 | 80 | 113 | 133 |

| __Other | 112 | 129 | 144 | 91 |

| Derivatives | 49 | 64 | 68 | 50 |

| Non-financial Assets | 46 | 44 | 42 | 41 |

| Other Assets | 64 | 66 | 70 | 33 |

| STOCKS (LIABILITIES) | 1663 | 1776 | 1935 | 1843 |

| Debt securities | 19 | 20 | 21 | 23 |

| Loans | 53 | 57 | 95 | 95 |

| Shares and Equities | 136 | 148 | 147 | 149 |

| Technical Reserves | 1334 | 1412 | 1517 | 1495 |

| _Non-life | 123 | 136 | 139 | 147 |

| _Life & Pension | 1211 | 1276 | 1377 | 1348 |

| __Unit & Index Linked | 586 | 611 | 669 | 711 |

| __Other | 625 | 665 | 708 | 637 |

| Derivatives | 40 | 55 | 55 | 40 |

| Other Liabilities | 80 | 84 | 101 | 41 |

| SELECTED TRANSACTIONS (Assets) b | ||||

| Currency and Deposits | 5 | -1 | -11 | |

| Loans | -1 | 38 | 8 | |

| Listed Shares | 7 | -3 | -2 | |

| Investment Fund Shares | 15 | 12 | 3 | |

| Source: Office for National Statistics, Bank of England, Prudential Regulation Authority | ||||

| Notes: | ||||

| a. technical reserve assets (also known as reinsurance recoverables) | ||||

| b. net acquisition of financial assets | ||||

| c. estimates may not add up due to rounding | ||||

| d. Q1 is Quarter 1 January to March, Q2 is Quarter 2 April to June, Q3 is Quarter 3 July to September and Q4 is Quarter 4 October to December. | ||||

Download this table Table 1a: Assets and liabilities of the UK insurance corporations sector, UK, Quarter 1 (Jan to Mar) 2016 to Quarter 4 (Oct to Dec) 2016

.xls (39.9 kB)

Table 1b: Assets and liabilities of the UK insurance corporations sector, UK, Quarter 1 (Jan to Mar) 2017 to Quarter 4 (Oct to Dec) 2017

| £ billion | ||||

| 2017 | ||||

|---|---|---|---|---|

| Q1 | Q2 | Q3 | Q4 | |

| STOCKS (ASSETS) | 1811 | 1804 | 1804 | 1853 |

| Currency and Deposits | 30 | 28 | 27 | 30 |

| Long-Term Government Securities | 194 | 191 | 187 | 186 |

| _Issued by UK Government | 141 | 139 | 136 | 133 |

| _Issued by non-residents | 53 | 51 | 51 | 53 |

| Other Debt securities | 339 | 338 | 332 | 333 |

| _Issued by UK residents | 153 | 152 | 150 | 153 |

| _Issued by non-residents | 185 | 186 | 183 | 181 |

| Loans | 123 | 127 | 131 | 133 |

| _To UK residents | 110 | 113 | 117 | 117 |

| _To non-residents | 14 | 14 | 14 | 16 |

| Listed Shares | 191 | 189 | 189 | 191 |

| _Issued by UK residents | 85 | 84 | 83 | 82 |

| _Issued by non-residents | 106 | 105 | 106 | 109 |

| Unlisted shares and Equities | 32 | 32 | 33 | 31 |

| _Issued by UK residents | 22 | 22 | 23 | 20 |

| _Issued by non-residents | 9 | 10 | 10 | 10 |

| Money Market Investment Fund shares | 70 | 70 | 74 | 78 |

| Non-Money Market Investment Fund Shares | 473 | 489 | 498 | 525 |

| Technical Reserves a | 235 | 222 | 219 | 233 |

| _Non-life | 39 | 41 | 47 | 43 |

| _Life & Pension | 196 | 181 | 171 | 190 |

| __Unit & Index Linked | 121 | 112 | 113 | 128 |

| __Other | 75 | 69 | 58 | 61 |

| Derivatives | 49 | 42 | 40 | 45 |

| Non-financial Assets | 40 | 40 | 41 | 38 |

| Other Assets | 35 | 35 | 34 | 31 |

| STOCKS (LIABILITIES) | 1811 | 1804 | 1804 | 1853 |

| Debt securities | 24 | 24 | 24 | 24 |

| Loans | 82 | 85 | 80 | 82 |

| Shares and Equities | 141 | 150 | 142 | 139 |

| Technical Reserves | 1454 | 1477 | 1456 | 1510 |

| _Non-life | 133 | 140 | 146 | 141 |

| _Life & Pension | 1321 | 1337 | 1310 | 1370 |

| __Unit & Index Linked | 698 | 720 | 712 | 754 |

| __Other | 624 | 617 | 599 | 615 |

| Derivatives | 40 | 36 | 33 | 36 |

| Other Liabilities | 69 | 33 | 68 | 62 |

| SELECTED TRANSACTIONS (Assets) b | ||||

| Currency and Deposits | 1 | -1 | -1 | 2 |

| Loans | -6 | 3 | 4 | 2 |

| Listed Shares | -12 | -1 | -2 | -2 |

| Investment Fund Shares | 11 | 11 | 9 | 17 |

| Source: Office for National Statistics, Bank of England, Prudential Regulation Authority | ||||

| Notes: | ||||

| a. technical reserve assets (also known as reinsurance recoverables) | ||||

| b. net acquisition of financial assets | ||||

| c. estimates may not add up due to rounding | ||||

| d. Q1 is Quarter 1 January to March, Q2 is Quarter 2 April to June, Q3 is Quarter 3 July to September and Q4 is Quarter 4 October to December. | ||||

Download this table Table 1b: Assets and liabilities of the UK insurance corporations sector, UK, Quarter 1 (Jan to Mar) 2017 to Quarter 4 (Oct to Dec) 2017

.xls (40.4 kB)

Figure 2: Share of assets of UK insurers in Quarter 4 (Oct to Dec) 2016

UK

Source: Office for National Statistics, Bank of England, Prudential Regulation Authority

Download this chart Figure 2: Share of assets of UK insurers in Quarter 4 (Oct to Dec) 2016

Image .csv .xls

Figure 3: Share of liabilities of UK insurers in Quarter 4 (Oct to Dec) 2016

UK

Source: Office for National Statistics, Bank of England, Prudential Regulation Authority

Download this chart Figure 3: Share of liabilities of UK insurers in Quarter 4 (Oct to Dec) 2016

Image .csv .xlsAnnual comparison of experimental Solvency II data with adjusted ONS survey data on insurance

ONS does not publish any data that can be directly compared with the experimental SII-based statistics. As explained, the insurance corporations sector is not currently separately identified in the national accounts.

However, it is possible to re-work financial aggregates from SII and from ONS insurance surveys to bring them both onto a more comparable basis. Results are shown in Figure 4 and, on this re-worked basis, the comparison is promising. It suggests that there is consistency between the adjusted ONS surveys and SII for the different instruments. It should be noted that Lloyds of London syndicates are included in the 2016 SII data but are not included in pre-2016 data. If we were to remove these syndicates the data would be more consistent, particularly for other debt securities.

Figure 4: Comparison of financial assets of UK insurers by instrument sourced from adjusted ONS survey data (until 2015) and Solvency II (in 2016)

UK, 2005 to 2016

Source: Office for National Statistics, Bank of England, Prudential Regulation Authority

Download this chart Figure 4: Comparison of financial assets of UK insurers by instrument sourced from adjusted ONS survey data (until 2015) and Solvency II (in 2016)

Image .csv .xls6. Conclusions

This article presents the first set of experimental financial statistics for the UK insurance corporations sector based on data from the Solvency II (SII) regulatory framework. The experimental statistics cover a selected set of financial accounts aggregates.

It should be noted in particular that SII replaced the previous Solvency I (SI) framework in 2016. Office for National Statistics (ONS) has recently concluded that SII data are suitable for national accounts compilation, including financial accounts aggregates.

SII provides quarterly as well as annual data and gives a greater level of detail, particularly for insurers’ holdings of financial assets and their exposure to the corresponding issuers (counterparties).

SII implementation is thus an important element of ONS’s enhanced financial accounts (EFA) programme. Under the EFA programme, ONS is working in partnership with the Bank of England to improve the quality and detail of financial data. Improvements planned under EFA include production of flow of funds (whom-to-whom) statistics. Where possible, the aim is to use administrative or regulatory data to deliver EFA improvements. Use of SII fits within this remit.

This publication of the SII-based experimental statistics is an important marker of progress for the EFA programme. Releasing experimental statistics at the earliest opportunity is one of the principles underpinning the EFA work. As well as giving an early sight of emerging data, we see experimental statistics as an opportunity for users to give us feedback on current development work.

The experimental statistics in this article show how SII promises to improve the quality and detail of the financial accounts for the UK insurance corporations sector. For example, SII allows us to present insurers’ technical reserves assets and liabilities on a non-consolidated, gross of reinsurance, basis as preferred under European System of Accounts: ESA 2010. The experimental statistics are also largely consistent with current ONS official publications based on surveys, hence SII has the potential to replace some of our existing insurance surveys.

However, before implementing these statistics in the national accounts, the following points will be considered further:

review of the treatment of pension fund managers, including specific treatment of partial pension fund managers

the split between life insurance and pensions; the improvements to SII templates currently being implemented in cooperation with the Prudential Regulation Authority (PRA) will make this possible

review of the treatment of insurers that are given waivers from SII data reporting

inclusion of SII-based data for insurance in experimental flow of funds statistics for the whole UK economy planned for 2019

Full implementation of Solvency II throughout the national accounts will include:

separate presentation of the insurance corporations and pension funds sectors; currently, insurance corporations and pension funds are presented as a combined sector

flow of funds statistics for insurance that are fully consistent with the official national accounts

review of the pre-2016 data for insurance in the light of the SII data for later periods, which may result in revisions to the historical national accounts data for the insurance corporations sector; 2020 is the earliest that full implementation is likely to be feasible

7. References

European Insurance and Occupational Pensions Authority (EIOPA) guidelines to the insurers and logs explaining the definitions of Solvency II (SII) templates were used to assess how closely the data collected by the SII templates matches national accounts requirements, as set out in the System of National Accounts 2008 and European System of Accounts: ESA 2010.

Price Waterhouse Coopers, “Solvency II – A guide to the new regime” was used to determine how insurers should interpret SII from a predominantly UK perspective. It gives further background information on the variables and templates and also explains which insurers would be completing the templates and which had waivers. It was important for understanding the population.

Mkandawire W. (2010a), “Measuring Lloyd’s of London in the National Accounts”, July 2010

Mkandawire W. (2010b), “A conceptually correct approach to treating Lloyd’s in the National Accounts”, September 2010

United Nations and European Central Bank (2015). Financial production, flows and stocks in the System of National Accounts, UN and ECB, New York, 2015

Organisation for Economic Co-operation and Development Understanding Financial Accounts, Paris, 6 November 2017

European Commission (2010). European System of Accounts 2010, Luxembourg, 2013

European Commission, International Monetary Fund, Organisation for Economic Co-operation and Development, United Nations, and World Bank (2008) System of National Accounts 2008, New York, NY: United Nations Bean C. (2015), Independent review of UK economic statistics: interim report, December 2015

Bean C. (2016), Independent review of UK economic statistics: final report, March 2015

Matthews D., Nolan L. (2016), The UK Flow of Funds Project: Introducing the Enhanced Financial Accounts, Office for National Statistics, 14 July 2016

Flow of Funds archived background information: