1. Main points

We are implementing improvements to our measurement of globalisation in the national accounts, focusing on the measurement of the activities of a small number of multi-national enterprises (MNEs).

There is no significant impact on gross domestic product (GDP), however, we describe the primary impacts on trade in goods, trade in services, and reclassifications from services to manufacturing.

Future developments will include a review of MNEs in the pharmaceuticals industry.

2. Overview of measuring globalisation in the UK National Accounts

Globalisation is a challenging topic for the national accounts. The establishment of our Large Cases Unit in 2019 (formerly the International Business Unit) to better understand the behaviour of multi-national enterprises (MNEs) was fundamental in developing our knowledge base and methods. For further information, see our Understanding multinational enterprises: insights from the International Business Unit and foreign direct investment statistics article.

Although the UK remains at an early stage in improving its measurement of globalisation in the national accounts, this article explains the impacts of improving the measurement of a small number of MNEs based on the framework outlined in our Globalisation in the context of the UK National Accounts: Blue Book 2023 article. We describe some of the conceptual and measurement challenges that surround globalisation and the future developments we expect to deliver in the coming years.

Back to table of contents3. Impacts of changes to how we measure globalisation

The first stage of improving our measurement of globalisation has focused on a small number of multi-national enterprises (MNEs), to enable us to develop our research and data capability.

At this early stage, our changes to measuring globalisation have had no significant impact on gross domestic product (GDP) or gross national income (GNI) growth. However, as we continue our research this may change, although there are no indications of whether this will be a positive or a negative impact.

There are more significant impacts to disaggregated components such as trade in goods, trade in services, output, and intermediate consumption. We focus on a subset of our impacts that will be integral as we make progress and improve estimates of the impact of globalisation. These include:

reclassifications from services to manufacturing

trade in goods

trade in services

These impacts are a result of the way in which transactions are recorded when economic ownership changes and international guidance on the classification of businesses.

Economic ownership describes how we think of the ownership of goods and assets. Economic ownership belongs where the associated economic benefits and risks lie. In most cases, a change in economic ownership occurs at the same time as a change in legal ownership. However, there are a small number of exceptions, for example, the economic and legal owner of leased assets may differ.

The classification of businesses is based on their activity. Guidance states that businesses which do not operate a manufacturing facility themselves could be classified as a manufacturer depending on how much involvement they have in managing their supply chain. For further details on this guidance, see our Globalisation in the context of the UK National Accounts: Blue Book 2023 article.

Impacts are given at a high level and as an average over 2018 to 2020 to meet our quality assurance and disclosure compliance.

Reclassification from services to manufacturing

An important feature of globalisation has been the outsourcing of manufacturing functions. The directing MNEs -- known as the principals - do not control a manufacturing facility but achieve control through the use of intellectual property, blueprints, and the ultimate ownership of finished goods.

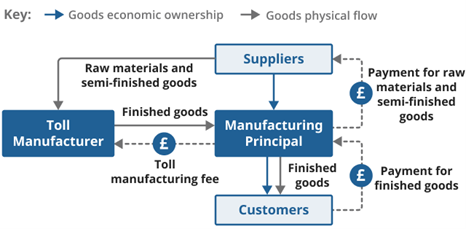

One form this takes is known as toll manufacturing. A principal in a toll manufacturing arrangement controls the procurement of raw materials and supplies and has continuous ownership of goods throughout the manufacturing process, paying the toll manufacturer a manufacturing service fee for the manufacturing services provided.

A common challenge in this arrangement is that principals in a toll manufacturing arrangement can be mistakenly classified to the wholesale industry. This is because the businesses do not operate a manufacturing facility, they take responsibility for distribution of finished goods. Whereas international guidance states that the business should be classified as a manufacturer if they are responsible for the provision of raw materials or semi-finished goods. For further details on this guidance, see the United Nations Economic Commission for Europe's Guide to Measuring Global Production.

Some of the businesses we have identified engaged in this model and have been historically misclassified in this way because of the complexities of their organisational arrangements. Through research of company accounts, survey data, administrative data, and discussions with the businesses, we have acted to reclassify the businesses where necessary and to adjust historical data in line with the operation of the model.

Trade in goods

Trade in goods is measured by HM Revenue and Customs (HMRC) administrative data as the physical movement of goods across the UK border. However, the data do not explicitly consider economic ownership of the goods. Additionally, it is unable to measure the movement of goods that are economically owned by a UK business, but which do not cross the UK border. We are able to explain and describe three different business models through comprehensive analysis of HMRC administrative data, Office for National Statistics (ONS) survey data, intelligence from counterpart national statistical institutes, and crucially, the help of the various MNEs.

Trade in goods - UK principals in toll manufacturing arrangements and merchanting

We have identified MNEs acting as principals in manufacturing arrangements using a network of factories outside of the UK to produce their output (for example, goods). In this case study, a small proportion of those goods crossed the UK border and were previously measured as imports. However, they were already under the economic ownership of the UK when they crossed the border because the principal, a UK entity, has ownership of the goods throughout the entire process.

Therefore, they have been removed from imports to ensure we only capture these movements when economic ownership changes. The remaining output was sold to markets outside of the UK. Our administrative data are unable to capture these transactions made outside of the UK, and therefore we have included them as additional exports from the UK.

In this case, the finished goods required significant raw material inputs. In using the factories outside of the UK, they sourced raw materials that never entered the UK but that, upon purchase, did move to UK economic ownership.

Furthermore, with detailed analysis, we have identified the entities engaged in merchanting. They source materials for the global supply chain of the MNE, including raw materials sold to principals in toll manufacturing arrangements, but do not carry out processing.

| Impact | Average 2018 – 2020 |

|---|---|

| Movement from services to manufacturing output | £2.6bn |

| Additional exports from principals in a toll manufacturing arrangement | £3.2bn |

| Additional Imports of intermediate goods from principals in a toll manufacturing arrangement | £0.9bn |

| Additional merchant export | £0.6bn |

| Additional merchant import | £0.5bn |

Download this table Table 1: Average annual impact of identified UK toll manufacturing principals on trade in goods and output, 2018 to 2020

.xls .csvTrade in goods - overseas principals in toll manufacturing arrangements

Additionally, we have identified UK-based toll manufacturers providing manufacturing services to an overseas principal at a number of UK factories. In this case study, the overseas principal purchases raw materials and retains ownership of them and the finished goods throughout the process.

The principal sources materials overseas and in the UK. Materials sourced in the UK are considered exports of the UK to the country of the principal even without physically leaving the UK. Imports of raw materials should be excluded as they remain under the ownership of the overseas principal.

| Impact | Average 2018 - 2020 | |

|---|---|---|

| Excluded exports of finished goods owned by the overseas principal | £0.6bn | |

| Excluded imports of raw materials owned by the overseas principal | £0.3bn | |

| Additional imports of finished goods sold in the UK by the overseas principal | £0.5bn | |

| Additional exports from the purchase of raw materials from UK suppliers by the overseas principal | £0.3bn |

Download this table Table 2: Average annual impact of identified UK toll manufacturers on trade in goods, 2018 to 2020

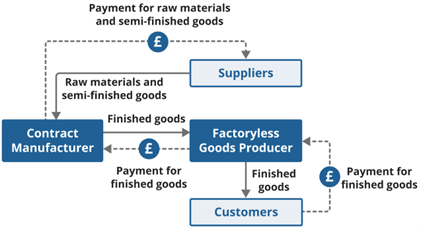

.xls .csvTrade in goods - factoryless goods producers

We have also noted factoryless goods producers (FGPs). They direct contract manufacturers abroad who are responsible for the purchase of raw materials and sell finished goods to the FGP at an agreed price. Our administrative data identify goods that are intended for the UK market as they cross our border but are unable to capture goods that are bought and sold overseas.

| Impact | Average 2018 – 2020 | |

|---|---|---|

| Additional exports of goods sold by the FGP | £1.4bn | |

| Additional imports of goods purchased by the FGP | £1.1bn |

Download this table Table 3: Average annual impact of identified UK factoryless goods producers (FGPs) on trade in goods, 2018 to 2020

.xls .csvTrade in services

Each of the MNEs we reviewed served as a global service centre within their respective group, commonly exporting corporate services such as computer services, research and development (R&D) services, and legal services. Royalties for the use of intellectual property were a significant part of their trade in services on both imports and exports.

The complexities of the business models are not easily captured in our traditional ONS surveys. Our dedicated Large Cases Unit has worked closely with selected MNEs to improve interpretation of the questions and deliver better informed and more comprehensive responses to our International Trade in Services Survey (ITIS). This ensures that we will capture the trade in services of these MNEs on an ongoing basis. As a result of this, additional trade in services have been identified as shown in Table 4.

| Impact | Average 2018 - 2020 | |

|---|---|---|

| Additional Trade in Service Exports | £0.8bn | |

| Additional Trade in Service Imports | £1.0bn |

Download this table Table 4: Average annual impact of identified multi-national enterprises (MNEs) on trade in services, 2018 to 2020

.xls .csvA separate article detailing the impact of globalisation on the main balance of payments (BoP) and international investment position (IIP) estimates, as well as other methodological improvements, will be published on 29 September 2023.

Back to table of contents4. Conceptual and measurement challenges

There are significant conceptual and measurement challenges associated with measuring globalisation.

The United Nations System of National Accounts 2008 (SNA 2008) began this process by recognising the importance of globalisation and economic ownership. Previously, ownership was implied when goods crossed a border, but the SNA 2008 recommended that imports and exports be recorded strictly when a change of ownership occurs. Other manuals, such as the International Monetary Fund Balance of Payments version 6 (BPM6), aligned to this recommendation.

From these principles, guidance has been developed further. Notably, the United Nations Economic Commission for Europe published The impact of globalization on national accounts and their Guide to measuring global production. These are essentially user guides, although national statistical institutes are often affected by the lack of available data.

The main unresolved conceptual issue is the treatment of factoryless goods producers (FGPs). Currently, because FGPs purchase and sell goods without further processing, they appear as a wholesaler. However, they also take part in the manufacturing process by providing intellectual property products (IPP) and directing the manufacture of goods. Because of this, they will be classified to manufacturing as if they were carrying out the manufacturing process themselves in future revisions to industrial classifications, as stated in the United Nations' Note on the main changes to ISIC Rev. 4.

The international statistical community is at an early stage of adopting globalisation guidelines. The consistent capture of business models, trade, and intellectual property have proven problematic. Not least because multi-national enterprises (MNEs) and their business models are continually changing and adapting to different local and global challenges.

In 2020, The European Commission's statistical branch, Eurostat, moved to standardise the first steps in processing globalisation estimates while recognising the substantial statistical challenge. It issued a transversal reservation to ensure all member states improved their measurement of globalisation. We have benefitted from the sharing of knowledge and best practice through this process including the consistent application of business models. For full information, see Eurostat's National and Regional Accounts quality report.

Understanding the prevalence of factoryless goods producers (FGPs)

FGPs in particular are hard to identify. Business surveys do not often gather the necessary evidence to distinguish them from typical distributors also classified to wholesale. Although they are more active in the manufacturing process, this may not be clear in the data because, in both cases, they report a purchase and sale of goods without further processing. Details of their purchases show that both types of firms are not involved in the physical transformation of the goods.

For further information on factoryless goods producers and their prevalence, using company websites and business surveys in both the UK and the US, see the Economic Statistics Centre of Excellence's (ESCoE's) No plant, no problem? Factoryless manufacturing and economic measurement paper. In their analysis, ESCoE uses the International Trade in Services Survey (ITIS) as the primary business survey for the UK. In particular, it focuses on two questions: merchanting and manufacturing services.

Merchanting is important because the import and subsequent export of goods produced by contract manufacturing services are likely to be reported here. Manufacturing services performed on goods owned by others addresses the issue more directly.

However, because the ownership of raw materials and semi-finished goods belongs to the principal, the question on manufacturing services is as likely to be associated with toll manufacturing arrangements (Figure 1 and Figure 2). For further information on definitions and the distinction between toll manufacturers and factoryless goods producers, see our Globalisation in the context of the UK National Accounts: Blue Book 2023 article.

Figure 1: Example of a factoryless goods producer arrangement

Source: Office for National Statistics

Download this image Figure 1: Example of a factoryless goods producer arrangement

.png (35.3 kB)

Figure 2: Example of a toll manufacturing arrangement

Source: Office for National Statistics

Download this image Figure 2: Example of a toll manufacturing arrangement

.png (42.1 kB)

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|

| Exports (£ million) | |||||||||

| Merchanting | 3,585 | 1,395 | 2,241 | 2,691 | 7,223 | 10,330 | Supp | 6,672 | 6,753 |

| Manufacturing Services | 2,555 | 2,103 | 2,350 | 2,735 | 3,518 | 2,739 | 2,832 | 3,033 | 3,991 |

| Charges for use of IP | 1,446 | 1,561 | 1,737 | 1,455 | 1,985 | 2,833 | 5,130 | 3,722 | 4,529 |

| Imports (£ million) | |||||||||

| Merchanting | 437 | 1,099 | 372 | 345 | 304 | 401 | Supp | 1,075 | 8,786 |

| Manufacturing Services | 760 | 581 | 627 | 601 | 925 | 1,256 | 1,165 | 1,433 | 3,606 |

| Charges for use of IP | 669 | 586 | 686 | 919 | 1,310 | 2,780 | 3,398 | 2,608 | 2,764 |

Download this table Table 5: International Trade in Services Survey (ITIS) data on selected service activities, 2013 to 2021

.xls .csvSource: International trade in services

ESCoE's text-based analysis of information was sourced from company websites and searched-for terms related to contract manufacturing. It highlighted "Life Sciences & Pharmaceuticals", "Chemicals", and "Biotechnology" as the three most prevalent sectors.

We are also adopting other lines of research using a range of business surveys. No surveys directly address these measurement issues, but some can give indications. For example, the Annual Survey of Goods and Services identifies firms classified to services industries but with significant sales of goods. This has been an effective tool in identifying companies that at first do not appear to be involved in manufacturing but are operating in either a toll manufacturing arrangement or are factoryless goods producers.

Outside of surveys, company accounts and direct communication with the businesses remain among the most reliable ways of establishing the operating models of MNEs.

Back to table of contents5. Future developments

We have already commenced a review of the manufacturing of pharmaceuticals industry (SIC 21). Our choice is based upon the initial analysis of survey microdata, which has highlighted that contract manufacturing and other manufacturing models are particularly prevalent in the pharmaceuticals industry.

The program of reviews primarily concerns accounting for multi-national enterprises (MNEs) in each industry as we will adjust at this level, but we will not make exhaustive adjustments to cover the entire industry as we lack the necessary data at this stage. We will concentrate on business models and structures, while considering the impact of economic ownership on trade. This may allow us to consider some of the challenges evident in supply and use tables for the industry and product under review.

In the long term, developments in new or existing data sources will allow us to further enhance estimates of the impact of globalisation across the economy.

Back to table of contents6. Glossary

Globalisation

This refers to the statistical measurement of economic globalisation. It is centred around the operation of multi-national enterprises and can include, for example, global production arrangements (including international supply chains and outsourcing) and flows of intellectual property.

Principal

The lead firm responsible for directing and coordinating activities. Often the owner of the intellectual property.

Toll manufacturer

An entity that provides a manufacturing service to a principal in return for a manufacturing service fee. They provide labour, expertise, and physical capital. The principal provides raw materials and semi-finished goods as well as the intellectual property products. Toll manufacturers are also referred to as toll processors.

Factoryless goods production (FGP)

An arrangement in which a principal provides intellectual property products such as technology and product designs, but outsources the entire manufacturing process, including the purchase of intermediate goods, to contract manufacturers. The principal is referred to as a factoryless goods producer. In other contexts, they may also be referred to as virtual manufacturers or fabless manufacturers.

Contract manufacturer

An entity that manufactures under contract according to agreed specifications with a principal. Typically, the contract manufacturer will procure raw materials and will be responsible for production of the specified product from beginning to end. It may be part of a factoryless goods production arrangement if the entire process is outsourced by a principal to contract manufacturers.

Multinational enterprise (MNE)

An enterprise producing goods or delivering services in more than one country.

Intellectual Property Products (IPP)

Original intangible creations, for example a story, invention, artistic work, or symbol. Ownership of intellectual property is protected by, for example, patents, copyright, and trademarks. These protections enable people and businesses to exploit their intellectual property for benefit.

Economic ownership

Describes how we think of the ownership of goods and assets in the national accounts. Economic ownership belongs where the associated economic benefits and risks lie. We should record transactions when economic ownership changes. In most cases, a change in economic ownership occurs at the same time as a change in legal ownership. However, some exceptions do apply, for example the economic and legal owner of leased assets may differ.

Back to table of contents8. Cite this methodology

Office for National Statistics (ONS), released 25 September 2023, ONS website, methodology, Measuring globalisation in the UK National Accounts: Blue Book 2023